|

|

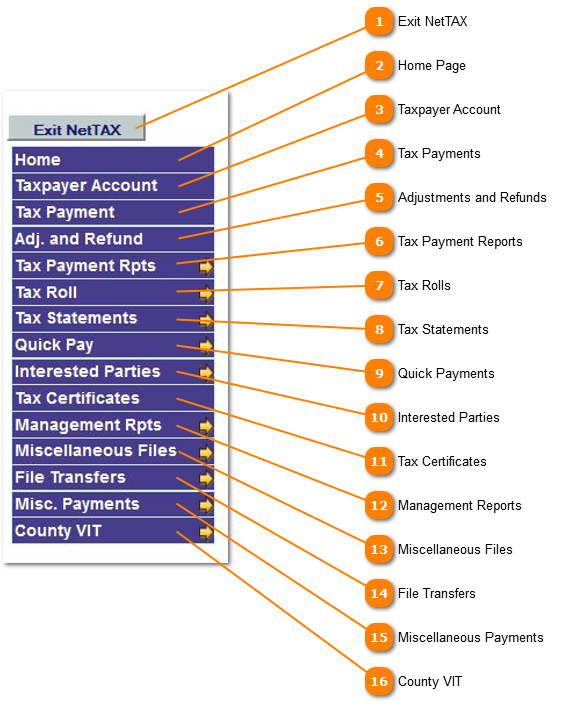

The Main Menu is where all the applications are accessed in the NetTAX Application. The Main Menu is always visible on the left of the screen no matter which application the user is in. To enter a feature move the mouse over the function and left click. If a sub menu is available the sub menu will be displayed by moving the mouse over the items marked with the yellow arrow  .

Exit NetTAX

Press this button to completely close the NetTAX application.

| |

Home Page

The Home page is the page with only the menu displayed

| |

Taxpayer Account

Taxpayer Account is where ALL the information is maintained about a specific account. All ownership, property location, mortgage information, tax records, exemption, values, notes, attorney information, payoff information, audit history and payment, adjustment transactions can be found under Taxpayer Account. This is also the area where account and tax record information is added, changed or deleted.

| |

Tax Payments

Tax Payments is where the majority of tax payments are made into the system. If the payment is a single check for several accounts it maybe easier to process the payments through on of the Quick Payments options below.

| |

Adjustments and Refunds

Adjustments and Refunds is the function to credit or debit tax records when adjustments are made to the tax record, a refund is processed or a check is returned "NSF".

| |

Tax Payment Reports

Tax Payments Reports provides a sub menu with several reporting options for payments processed to tax records.

| |

Tax Rolls

Tax Rolls provides a sub menu with several reporting options for printing delinquent and current taxrolls.

| |

Tax Statements

Tax Statements provides a sub menu with several options for printing; delinquent statements, current statements and notices.

| |

Quick Payments

Quick Payments provides a sub menu with two options for processing single checks paying multiple accounts. This is particularly useful for the process of mortgage company and mineral accounts.

| |

Interested Parties

Interested Parties provides a sub menu to enter and maintain information concerning mortgage companies, agents, tax services.

| |

Tax Certificates

Tax Certificates provides for the ability to process and bill for Tax Certificates.

| |

Management Reports

Management Reports provides a sub menu with several reporting options for various reports.

| |

Miscellaneous Files

Miscellaneous Files is the area where the system setup and configuration is takes place for the tax office.

| |

File Transfers

File Transfers is where the applications are with the export tools to extract information from the data base.

| |

Miscellaneous Payments

| |

County VIT

County VIT helps the Tax Office collect and manage Vehicle Inventory Taxes.

| |

|

|