| < Previous page | Next page > |

How To... Payments

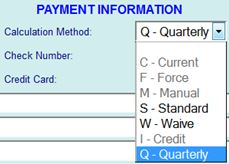

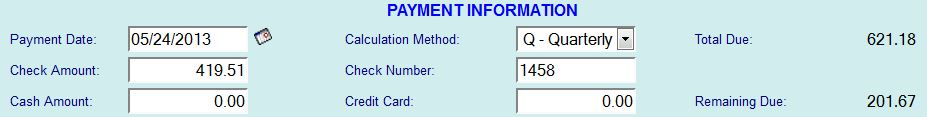

NOTE: When making a quarterly payment on an account that also has delinquents, the delinquents and the quarterly payment must be made separately. When entering the delinquent portion of the payment, change the calculation method from "QUARTERLY" to "STANDARD". For the check amount, enter the amount that is being paid on the delinquents. The remainder will be the amount that will be paid on the quarterly when making the quarterly payment. The 2 amounts will then add up to the total check amount.

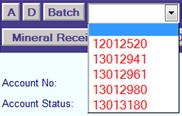

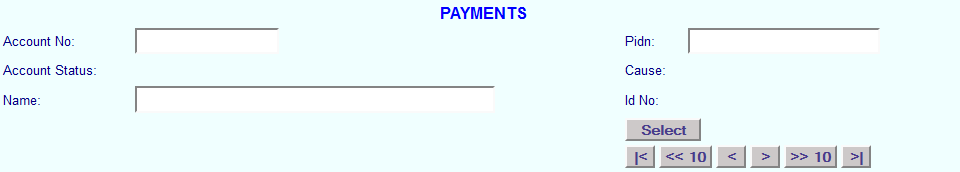

NOTE: If the information entered is a direct hit on an account in the database, the account information will appear on the screen. If the information entered has multiple possibilities, the possible candidate's screen will appear to scroll through to find the account to be selected (See also the instructions on How to … Find an Account record for more information).

Enter the date of the payment. Today's date will populate this field but can be changed either by manual input or by choosing for the pop up calendar.

NOTE: This will also be the date of the penalty, interest, and attorney fee calculations.

Enter the check, cash, and/or credit card amounts. If an amount is entered in the check amount, enter the check number.

Note: The check number must be unique for each account, year and entity. There should never be a duplicate check number. If you get an error message, (eg "... Violation of primary key PK_Taxtrans...") try using a different check number or go verify that the check number hasn't been entered by someone else.

To POST Payment

If the amount entered is the payoff amount, the computer will post the payment and nothing else needs to be entered.

NOTE: If one check is being used for payment on multiple accounts you must enter the same check number for both accounts with the exact amount being paid. See How To...Pay Multiple Accounts.

|

| < Previous page | Next page > |