| < Previous page | Next page > |

How To... Add an Adjustment

Select "Adj. and Refund" from the Main Menu

NOTE: This is also used to reverse a payment.

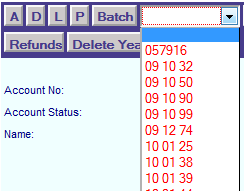

Select a "Batch ID" from the drop down box or see "Create or select a Batch ID" to create a new Batch ID.

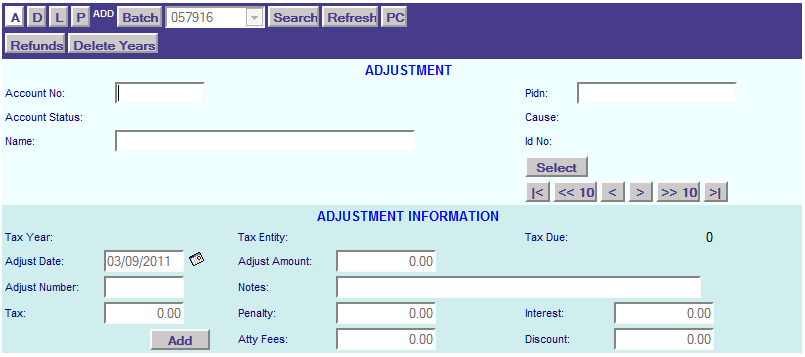

If the information entered is a direct hit on an account in the database, the account information will appear on the Adjustments screen.

If the information entered has multiple possibilities, the possible candidate's screen will appear to scroll through to find the account to be selected (See also the instructions on How To … Find an Account record for more information).

Press the "Select" button to start the adjustment.

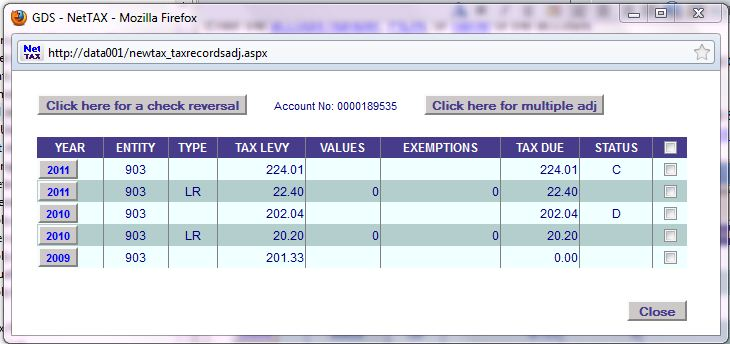

Select the year, entity and type of the tax record to be adjusted.

NOTE: The TYPE column refers to other charges or other payments that are on the account. These other charges can be found on page 3 of the account.

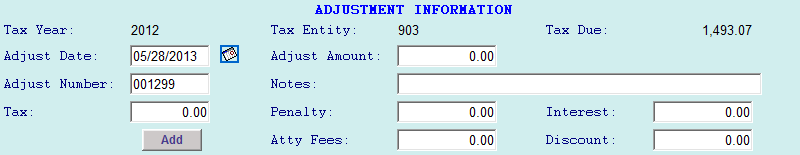

Enter all required Adjustment Information: Date, Amount, Number, Notes, Tax, Penalty, Interest, Atty Fees, Discount:

NOTE: The adjust amount will include any discounts. The total of the tax plus penalty plus interest plus attorney fees plus discount amounts will be your adjust amount.

NOTE: The adjust number is auto generated or you can enter the check number of the check being issued to the taxpayer.

NOTE: If the amount being entered is debiting the account (refund to the taxpayer) then the number is positive. If the amount being entered is crediting the account (payment from the taxpayer) then the number is negative.

Repeat this process for all the adjustment and refunds to be entered. After all the adjustment and refunds are entered, click on the “L”

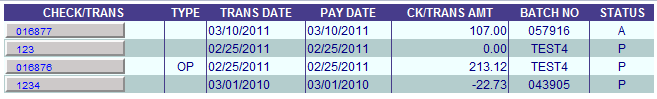

NOTE: At this point, the adjustments have not been posted to the accounts. If you look at page 3 of the account and click on the "Transactions" button, there will be an "A" in the "STATUS" column meaning that the adjustment has not been posted yet. The "P" means the transaction has been posted.

|

| < Previous page | Next page > |