| < Previous page | Next page > |

How To... Balance the Snapshot

When running the snapshot, keep in mind that this report is NOT date driven. It is a report of what is currently on the system when it is run. So any value, exemption, and levy changes made or payments and adjustments made will change the figures on this report.

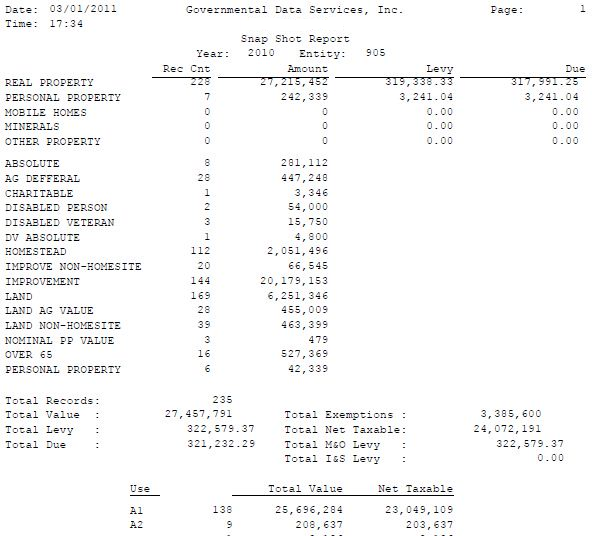

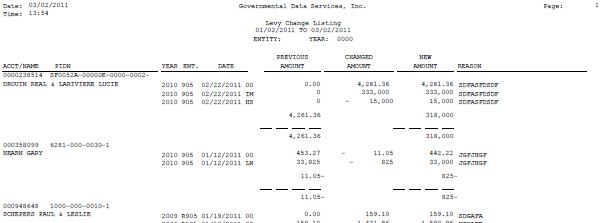

At certification, when GDS loads the certified tax roll from the Appraisal District, the values and exemptions are balanced to what the Appraisal District has. These are the beginning totals. Throughout the year, the Appraisal District will issue supplemental corrections/additions. After loading these changes, run the snapshot to verify that all the figures have been entered correctly. If not, then run a “Levy Change Listing” and compare with the supplemental printouts from the Appraisal District.

A current tax roll detail can also be run for a specific SPTB use code or a specific value or exemption code to help determine where the error might be.

To make balancing at the end of the month easier, be sure that the changes are done within that balancing month. In other words, finish making the changes for a supplemental before closing out the month.

NOTE: Things to look for when out of balance with the Appraisal District:

Sample Levy Change Listing:

|

| < Previous page | Next page > |