|

|

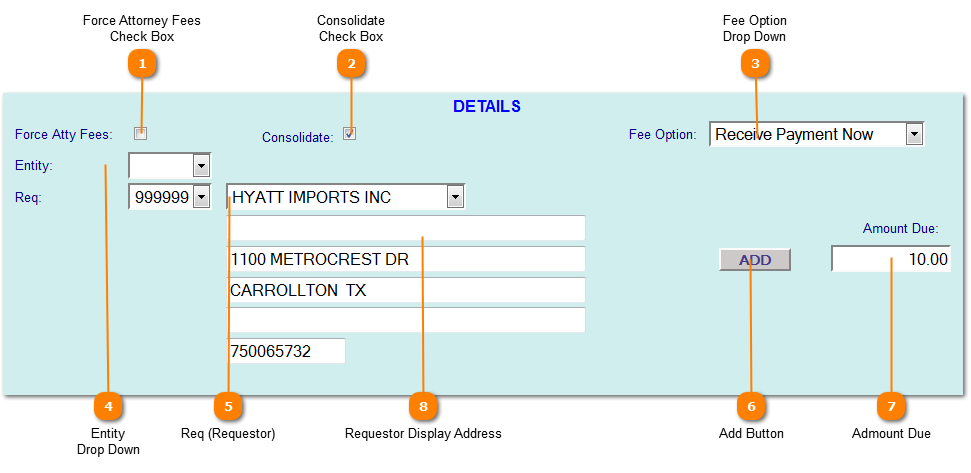

Tax Certificates | Details Section

Force Attorney Fees Check Box

Check the Force Atty Fees check box if attorney fees are to be added to the current year delinquent taxes.

This option defaults to checked if the account status contains a "S", "L" or "I".

This only applies to the months of February - June.

| |

Consolidate Check Box

Check the Consolidate check box to produce a tax certificate with the amounts due as a single tax jurisdiction; totals all entities records as one for a tax year. Leaving this box unchecked lists each taxing entity separately; by entity and year.

| |

Fee Option Drop Down

Select the method of payment for this Tax Certificate. The options are:

Receive Payment Now = accept payment when issued.

No Charge = there will be no charge for this tax certificate.

Bill Later = bill a tax certificate requestor (title company) at a later date.

| |

Entity Drop Down

Select a specific entity if the tax certificate is for an individual tax entity.

Leave blank to include all taxing entities which the tax office collects for.

| |

Req (Requestor)

If the tax certificate is for a specific Tax Certificate Requestor enter the Requestor ID here.

If the requestor is not on file the "999999" Requestor ID permits the entry of a Requestor Name.

In order to bill for a tax certificate the certificate must be to a valid requestor set up in the Interested Parties, Tax Certificate Requestors application.

| |

Add Button

Click the Add button when all the information is correct and the tax certificate is ready to be created.

| |

Admount Due

The amount to be received on this tax certificate. The default amount is maintained in the Miscellaneous Files, Tax Entity Records.

| |

Requestor Display Address

The requestor address display shows either the property owners address or if a valid requestor is entered the requestors address.

| |

|

|