| < Previous page | Next page > |

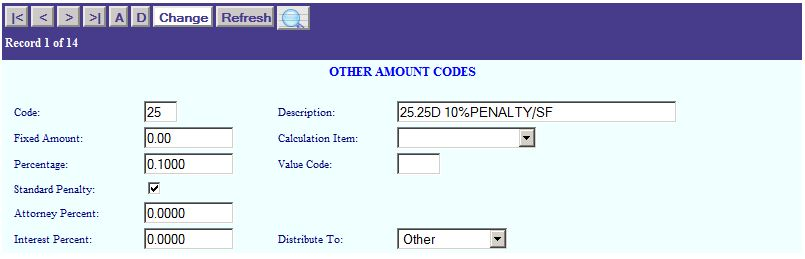

How To... Change an Other Amount record

To change an "Other Amount" record, select the Other Amount by navigating through the records using the “<” and “>” buttons in the application control section.

Make the appropriate changes and click on the "Change" button in the application control section to save the changes.

DESCRIPTION

The Description is a 20 alpha-numeric character description of the Other Amount Code. This description will print on statements, rolls and on the screen.

The Fixed Amount is the flat rate that is typically charged for this other amount code. An example of a fixed amount record might include a return check fee, where a standard amount is charged.

Percentage is the amount used to calculate the other amount based off the "Calculation Item" selected. The percentage is entered not as a percent but the actual multiplier. If calculating 10% of the calculated levy on a tax record; enter .10 in the Percentage, select "Total Levy" as Calculation Item. (The result is a late rendition fee of 10%).

Standard Penalty indicates that this record is to calculate standard penalty when delinquent. If unchecked, then no penalty amount will be calculated.

Attorney Percent is the percentage the system will calculate the attorney fee for this Other Amount when delinquent. The percentage is entered as a decimal and not as a percentage (eg. 10% should be entered as 0.10).

Interest Percent is the percentage the system will calculate the interest fee for this Other Amount when delinquent. The percentage is entered as a decimal and not as a percentage (eg. 10% should be entered as 0.10).

Calculation Item is the item in the tax record where the other amount will use as the basis of it's calculation. Valid entries are:

Net Taxable: fees are based off the Net Taxable value (Total Value - Total Exemptions).

Total Levy: fees are based off the Total Levy (Net Taxable * Tax Rate/Tax Ratio).

Total Value: fees are based off the Total Value (Sum of all values).

Value Code: fees are based off a specific value code, enter the value code in the "Value Code" field below.

Value Code is the specific value code to use as the basis for calculating the "Other Amount" value. This only applies if "Value Code" was selected in "Calculation Item" above. The value code must be a valid code set up in "Exemption, Value and Return Mail Codes" application.

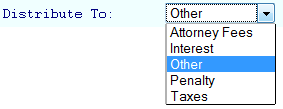

Distribute To is the category the collected amounts for this other amount will be included in the when running the Distribution reports and general ledger transfer routine. Valid selections are:

Select Attorney to apply the transaction amount as attorney fees.

Select Interest to apply the transaction amount as interest.

Select Other to apply the transaction amount to it's specific category listed separately.

Select Penalty to apply the transaction amount as penalty.

Select Taxes to apply the transaction amount as taxes.

NOTE: It is suggested to use "Other" for "Distribute To:" This separates out the payment amounts as separate totals for your accounting department.

|

| < Previous page | Next page > |