VIT Monthly Payment Posting

The VIT Monthly Payments Posting Page allows you to post monthly payments for Vehicle Inventory Tax records.

VIT No

Enter the Vehicle Inventory Tax account number here. This number has to be exact, no partial entries.

NOTE: You can not search by any other criteria in VIT mode.

|

|

Search Button

Clicking the Search button to pull up the account by year that was entered.

|

|

Year Drop Down

Choose the year to bring up the VIT Tax Record.

|

|

Owner Name

Once you've input the VIT number the owner's name will populate here.

|

|

Owner Address

Once you've input the VIT number the owner's address will populate here.

|

|

Buiness name

Once you've input the VIT number the Business Name will populate here.

|

|

Location

Once you've input the VIT number the Business Location will populate here.

|

|

Factor

Initially the Factor is the tax rate that is calculated by the county at which the motor vehicle dealer will be taxed.

NOTE: This Factor amount can be changed by the dealer based on sales so they don't over or under pay their VIT taxes.

|

|

Post a Payment Button

Once a month is chosen in the drop down click POST a PAYMENT to enter the payment information.

|

|

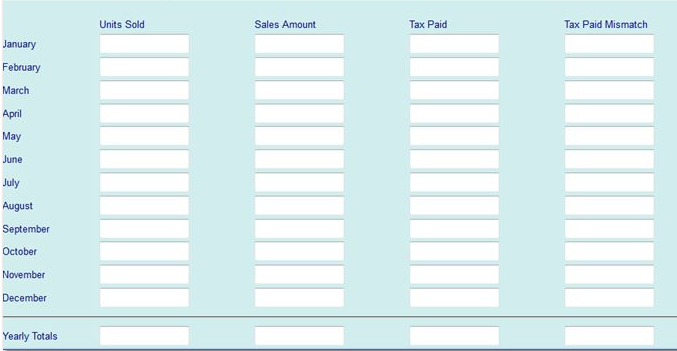

Yearly Sales Chart

These fields get populated after a payment has been posted or adjusted.

|

|