| < Previous page | Next page > |

How To... Penalty and Interest Calculations

GDS calculates penalty, interest, and attorney fees separately and separately for each each taxing entity and year. Calculate the figures for penalty (rounded to 2 decimal places) and interest (rounded to 2 decimal places) before calculating the attorney fees.

Quarterly Amounts and Disaster Relief:

Disaster Relief is very similar to quarterly payments. Quarterly payments only apply to over 65 and Disabled Person accounts where disaster relief applies to all homestead accounts. Also the penalty for quarterly payments is 6% whereas the penalty for disaster relief is 12%.

When calculating what the quarterly amount would be on an account, take the levy and divide by 4 and then round. The fourth payment will then be the levy - (quarterly amount * 3) Do this for each entity and then add the amounts together for each quarter.

Example:

School Levy is 1,234.57 and the City levy is 234.77.

The school quarter amount = 1,234.57 / 4 = 308.6425 = 308.64

The fourth payment amount = 1,234.57 - (308.64 * 3) = 308.65

The city quarter amount = 234.77 / 4 = 58.6925 = 58.69

The fourth payment amount = 234.77 - (58.69 * 3) = 58.70

The first three quarter amounts will be 308.64 + 58.69 = 367.33

The fourth quarter amount will be 308.65 + 58.70 = 367.35

NOTE: The WRONG way would be to add the school levy and the city levy together and then divide by 4.

1,234.57 + 234.77 = 1,469.34 / 4 = 367.335 = 367.34 and the fourth payment = 367.32.

A payment can be made to the first, second, third, or fourth quarter of a quarterly record. The penalty is 6% (12% for disaster relief) of the amount that is past due. The interest is 1% per month on the amount that is past due.

NOTE: Attorney fees, if forced, are calculated only on the past due amount plus the penalty and interest amounts.

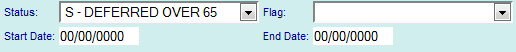

Tax Deferrals:

When calculating tax deferrals, be sure to enter the start date that the tax deferral started in the start date field on page 2. When the deferral ends, enter the date in the end date field. Leave the end date as "00/00/0000" until the account no longer qualifies for the deferral. Standard penalty and interest will be calculated on the account up to the month before the deferral start date. (2/3)% per month (8% per year) interest will be calculated for each month starting with the month they qualify for the deferral and added on top of the standard penalty, interest and attorney fees already calculated.

NOTE: Attorney fees, if forced, are calculated on the tax due amount plus the penalty and interest (including the deferred interest) amounts. If attorney fees are not forced, then only the standard attorney fees apply (before tax defferal started).

Alternate Delinquency Date:

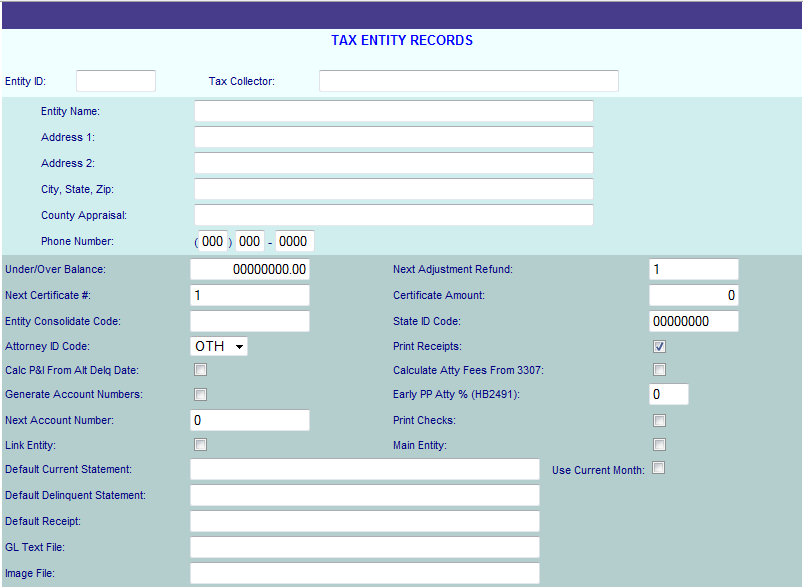

When an alternate delinquency date is entered on a tax record, penalty, interest, and attorney fees will not be calculated until the payoff date is equal to or greater than the alternate delinquency date. To start penalty and interest calculations from the alternate delinquency date instead of from the standard February 1st date, go to Tax Entity Records and put a check mark in the box for "Calc P&I From Alt Delq Date:" for each entity record.

NOTE: Putting a check mark in this field will make all tax records that have an alternate delinquency date start the P&I calculations from the alternate delinquency date instead of the standard February 1st date.

Standard Delinquency Dates for tax records with a value or exemption change.

Statement postmarked by: Alternate Delinquency Date:

January 10 February 01

February 07 (not a leap year) March 01

February 08 (leap year only) March 01

March 10 April 01

April 09 May 01

May 10 June 01

June 09 July 01

July 10 August 01

August 10 September 01

September 09 October 01

October 10 February 01 (current year only)

November 01 (prior years)

November 09 February 01 (current year only)

December 01 (prior years)

December 10 February 01 (current year only)

January 01 (prior years)

|

| < Previous page | Next page > |