|

|

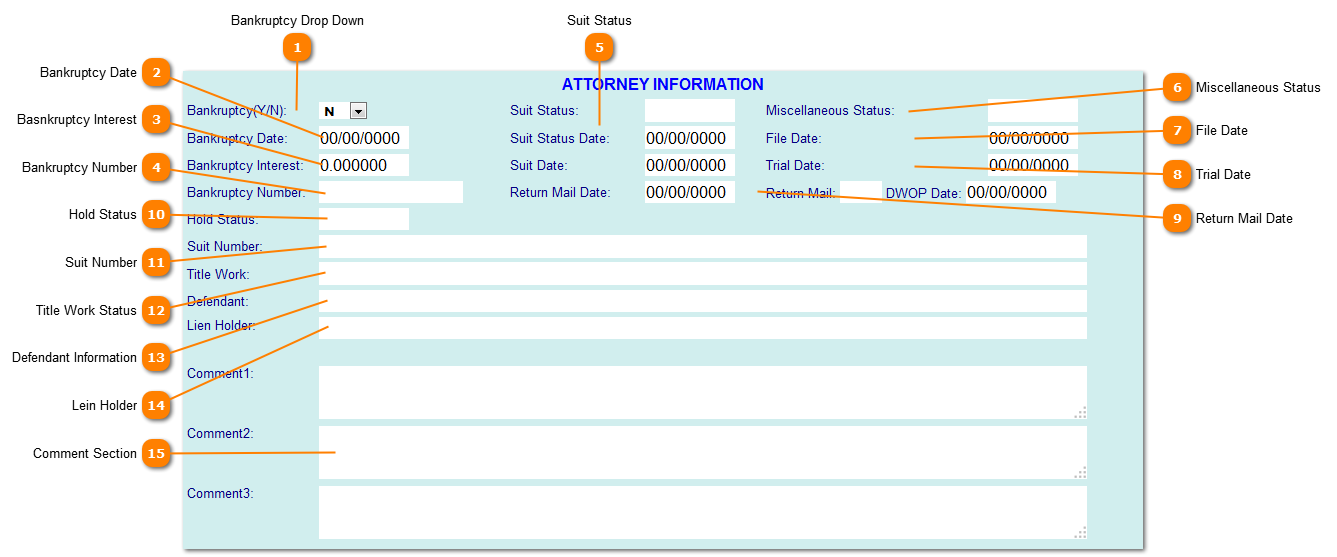

Attorney Information (Page 7) | Attorney Information

Bankruptcy Drop Down

Select the from the Bankruptcy(Y/N) Drop Down either "Y" or "N" regarding the bankruptcy status of this account. The default is "N".

| |

Bankruptcy Date

Enter the date this account entered into a bankruptcy.

| |

Basnkruptcy Interest

Enter the percentage of this account which applies to the bankruptcy. Enter 1 if the entire account is in bankruptcy.

| |

Bankruptcy Number

Enter the bankruptcy number assigned by the court for this case.

| |

Suit Status

Attorney suit status information

| |

Miscellaneous Status

A Miscellaneous Status can be a code to denote special handling of the suit.

| |

File Date

Enter the file date that this suit was filed in the county courthouse.

| |

Trial Date

Enter the date this suit goes to trail.

| |

Return Mail Date

Enter that date certified mail was returned undeliverable from this account regarding the filing of the suit.

| |

Hold Status

Attorney Hold Status information.

| |

Suit Number

If the account is under suit, litigation, judgment then enter the suit number and any other pertinent information.

| |

Title Work Status

Describe the status and any notes regarding the Title Work being perform for the suit.

| |

Defendant Information

Enter any information regarding the Defendant for this suit.

| |

Lein Holder

Enter names and notes regarding any Lean Holders for this account.

| |

Comment Section

The Comment Section is an area where specific comments can be made regarding this account.

| |

|

|