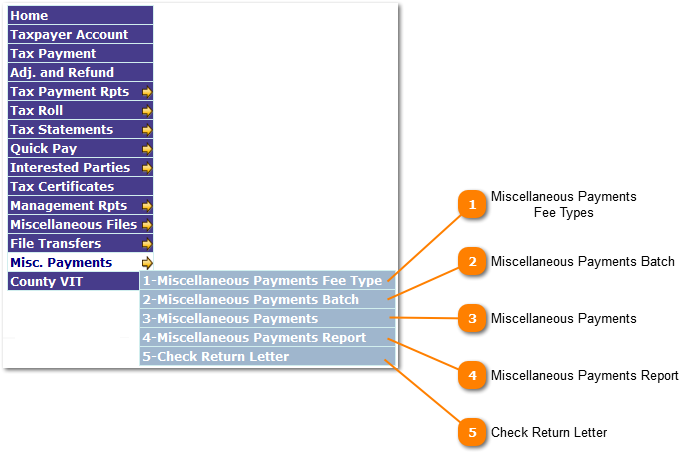

Miscellaneous Payments captures and tracks payments which are not related to a specific tax account. Examples include; tax certificates, copies, duplicate receipts.

Miscellaneous Payments

Fee Types

Miscellaneous Payments Fee Types is the application to add, change and list the types of fees the tax office will be collecting for.

|

|

Miscellaneous Payments Batch

The Miscellaneous Payments Batch is the application which has the ability to add and change the batch-id for miscellaneous payments. A different batch is required for tax payments and batch payments. Each batch should be closed when there are no more payments to be included.

|

|

Miscellaneous Payments

Miscellaneous Payments provides for the entry and delt

|

|

Miscellaneous Payments Report

The Miscellaneous Payments Report provides the information on payments processed through the miscellaneous payments system. The report can be run by either batch id or date range. It also allows for a detail (transaction by transaction) listing or a summary by type.

|

|

Check Return Letter

<TODO>: Insert description text here...

|

|