| < Previous page | Next page > |

How To... Purge Quarterly Records

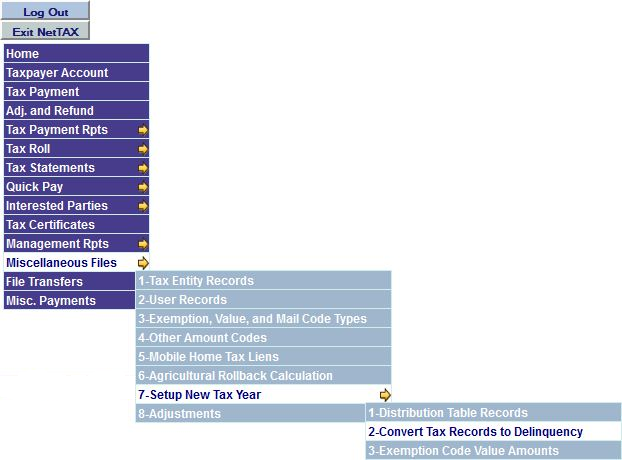

Select "Convert Tax Records to Delinquency" from the "Setup New Tax Year" menu under the “Miscellaneous Files” menu.

There are 7 different tax status codes. This program will go through the tax records and reset the tax status codes as to what they need to be:

“ ” - Tax due = 0

“O” - Tax due < 0

“P” - Over 65 Quarterly and tax due > 0

“R” - Disaster Relief and tax due > 0

“S” - Deferred Over 65 and tax due > 0

“D” - Delinquent and tax due > 0

“C” - Current and tax due > 0

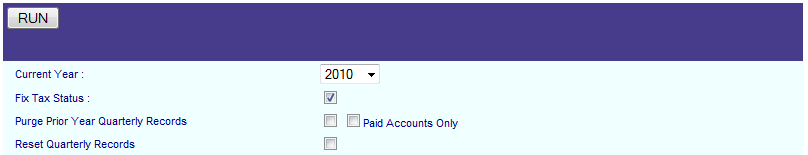

Click on the “RUN” button to execute the program.

This program should be run after February 1st of each year to change the current year tax records that still have an amount due from “C” to “D”. You should also run this program before running the Delinquent Summary as the Delinquent Summary reports the amount due under each tax status (See How to … Balance).

Another date of note is September 1st. This signifies the start of a new tax year. On or after September 1st, one should put a check mark in the box next to “Purge Quarterly Records”. This will delete all the quarterly records so that they can be set up for the new tax year. Tax records that still have a tax due will revert back to standard penalty and interest. Any quarterly records that have a tax year less than the current year will be deleted.

NOTE: If you put a check mark in the "Paid Accounts Only" check box, then Quarterly records that still have a tax due will not be deleted. You will not be able to set up another quarterly record on these accounts until the prior quarterly records have been paid in full.

Put a check mark in the box for “Reset Quarterly Records” to sync the quarterly record with the account in case they are out of sync (i.e. Payment delete, supplemental change, etc.).

|

| < Previous page | Next page > |