GDS NetTAX Help System

Main Menu

Tax Payer Account

Miscellaneous Files

NetTAX How To...

How To... Miscellaneous Payments

| < Previous page | Next page > |

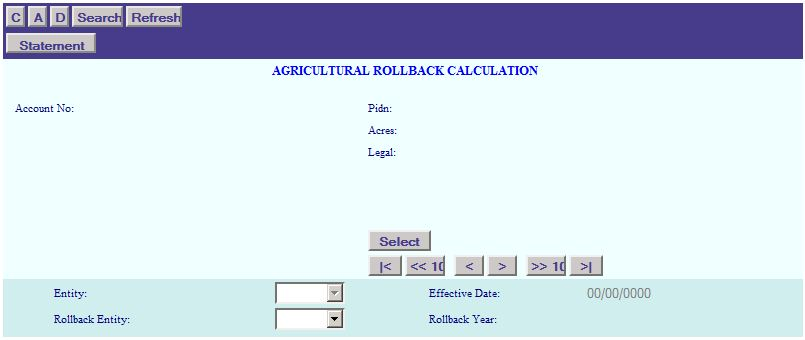

How To... Change an Agricultural Rollback

Click on the “C” in the application control section to enter the “CHANGE” mode. Enter the Account Number, or PIDN.

NOTE: Select/Enter the account that will be receiving the rollback statement.

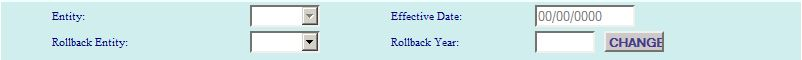

Select the Rollback Entity and Rollback Year.

Choose the "Rollback Entity" for the above selected Entity. (The Rollback Entity will typically have an "R" in front of the entity code.

Enter the "Rollback Year". The Rollback Year will be the last year being rolled back plus 1.

e.g. - if the years being rolled back are 2005 - 2009, the rollback year will be 2010.

After entering all the information, click on the “CHANGE” button to continue.

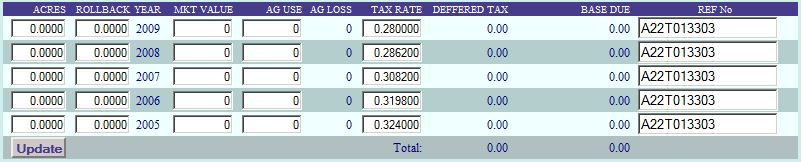

Make the appropriate changes and when finished click on the "UPDATE" button.

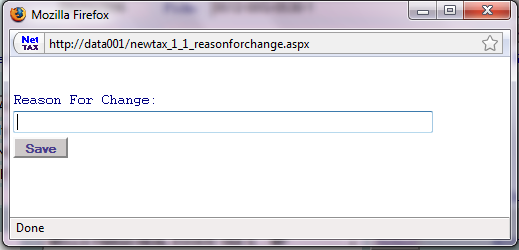

The system will then prompt:

Enter the reason for making this change. The NetTAX system maintains a description of changes made to records along with the date and the user who made the change. Click the "Save" button to record the change.

Click on the "Statement" button in the application control section to print an updated Agricultural Valuation Rollback Statement.

|

| < Previous page | Next page > |