GDS NetTAX Help System

Main Menu

Tax Payer Account

Miscellaneous Files

NetTAX How To...

How To... Miscellaneous Payments

| < Previous page | Next page > |

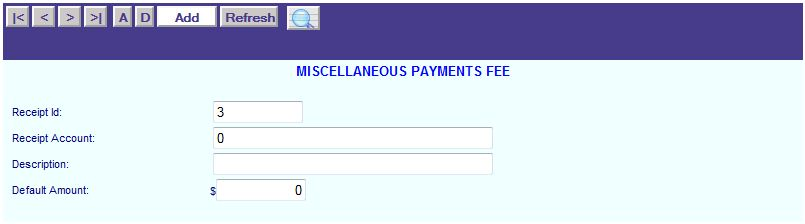

How To... Add Miscellaneous Payment Fee types

Click on the “A” in the application control panel to enter the “ADD” mode.

Enter a unique Receipt ID for the fee type (needs to be a number).

Note: It is best to have the Receipt ID equal 1 for “TAX CERTIFICATES”. This will make entering Tax Certificate payments easier. The Receipt account will be your internal general ledger account number (up to 25 Alphanumeric characters long).

Enter the default amount for this fee type.

NOTE: For Tax certificates, enter the default amount in the Entity table also.

|

| < Previous page | Next page > |