| < Previous page | Next page > |

How To... Use Quick Pay

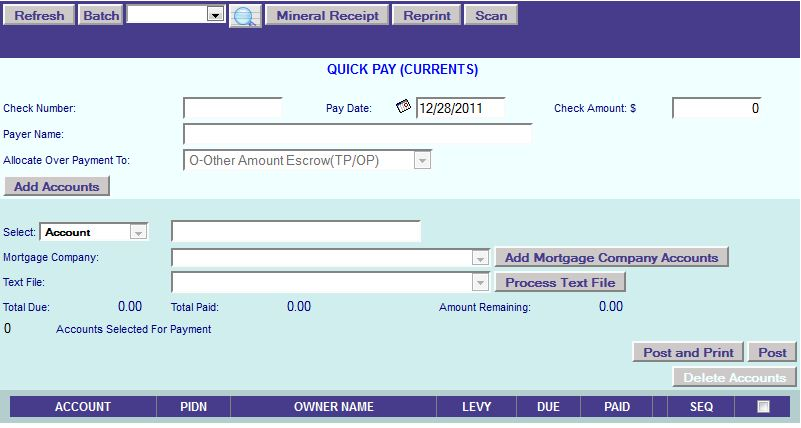

“Quick pay – Currents” will only pay the current year for the accounts selected (no penalty or interest is calculated).

“Quick pay – Delinquents” will pay all years due for the accounts selected (standard penalty and interest is calculated).

In “Quick pay – Delinquents”, the current year can be included or excluded.

The pay date will be the penalty and interest calculation date. If in “Quick Pay – currents”, the pay date must be between 09/01 and 01/31.

Select from the "Allocate Over Payment To:" drop down where to allocate any over payments that might occur.

O – Other Amount Escrow (TP/OP) to apply the overage to Other Amounts

T – Tax payer refund will apply the overage to the base tax where other amount escrow will allocate the overage to other amounts.

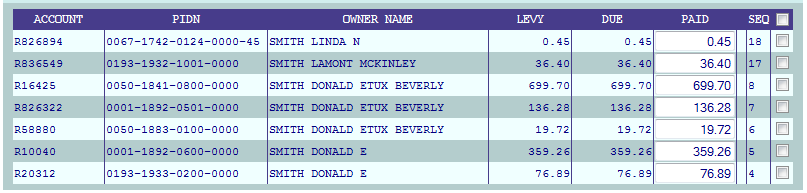

There are several ways to select the accounts to pay. If you know the Account No, PIDN, Name, or Owner ID then select the appropriate method from the "Select" drop down menu and then enter the Account Number, PIDN, Name, or Owner ID (respectively). The system will then bring up all the accounts that apply.

For example, if you enter the name “BROWN”, the system will bring up all the accounts with the name “BROWN” that have current year taxes due (“Quick Pay – currents”) or all the accounts with the name “BROWN” that have delinquents due (“Quick pay – delinquents”).

If you are in “Quick pay – delinquents”, there is a check box above the button “Add Mortgage Company Records” labeled “Include Current year?”. Put a check mark in this box if you wish to include the current year or uncheck this box if you do not wish to include the current year. You can also select a mortgage company to pay by selecting the mortgage company from the drop down menu and clicking on the “Add Mortgage Company Accounts” button.

The system will not let you select more accounts to pay than what is in the Check Amount field (The “Amount Remaining” field will be added to or reduced from as accounts are added or deleted). If after entering all the account to pay and the check amount does not equal the total amount (there is an amount remaining), then verify by going through the list to see if an account was added in error or if an account might have been missed.

To delete an account from the list, put a check mark in the box to the far right on the line item to be deleted and then click on the button “Delete Accounts”. To delete all the accounts and start over, then put a check mark in the box to the right of “SEQ” and immediately under the button “Delete Accounts” and then click on the button “Delete Accounts”.

If there is still an amount remaining, then go through the list and see if maybe there is a difference between the “LEVY, “DUE” and “PAID” columns. It is possible that the account might have had a payment already applied, or has had a supplemental. In these cases, you can change the amount paid on the account as long as there are not multiple entities on the account by entering the amount under the “PAID” column.

After entering all the accounts and you find that there is an amount still remaining, you must decide which account you want to apply the over payment to by either adding the amount to the “PAID” column of the account or delete the account from the list and post the payment manually.

If there is not enough money to pay all the accounts, then the decision must be made as to which accounts are not going to be paid.

If there is an amount remaining, then the system will prompt “Disregard remaining balance?”. Click on the ”Yes” button to post the payment to the system. The balance remaining will not be posted to the system. This must be done manually.

NOTE: The accounts will remain in the list under your user initials until you either post the accounts of delete them from the list, even if you were to exit the GDS system and return later to finish.

|

| < Previous page | Next page > |