| < Previous page | Next page > |

How To... Balance the Recap

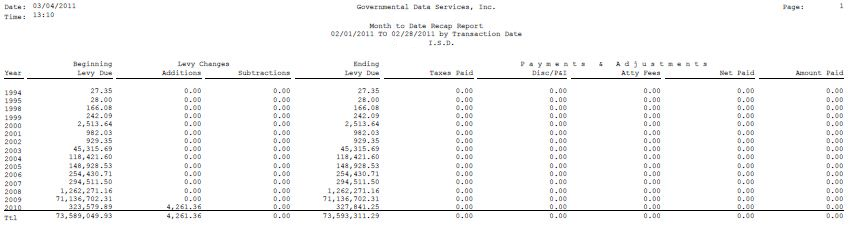

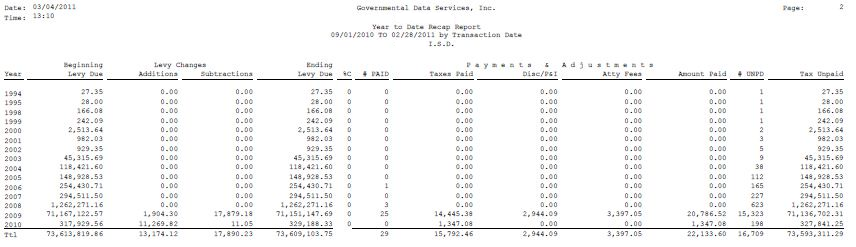

The recap report is broken down into 2 different parts: A Month to date and a Year to date report. This report contains the Beginning levy due as of the start date, the sum of the additions and subtractions to the levy between the Start date and the End date, Ending levy due (Beginning levy due plus additions minus subtractions), Taxes, Discounts/Penalty and Interest, and attorney fees paid between the start date and the end date. The Year to date part will also have the Tax unpaid column. This report is comprehensive and will take some time to load. If all the figures for a particular year are 0.00 then that year will not show up on the report.

Things to look for when Balancing the Recap:

1. The Tax Unpaid column from the year to date on the month prior's recap report will match up with the Beginning Levy Due column from the month to date on this month's recap report.

2. The Levy Changes Additions column and Subtractions Column (from both Year to date and Month to date) will match up with the totals from the Levy Change Listing when run using the same start date and end date.

3. The Ending levy due should be the Beginning levy due plus additions minus subtractions.

4. The Taxes Paid column, Disc/P&I column, and Atty Fees column (from both Year to date and Month to date) will match up with the Distribution Report when run using the same start date and end date.

5. The Tax Unpaid column should be the Ending levy due minus Taxes Unpaid. The Tax Unpaid column should also match up with the delinquent summary and the current year tax unpaid should match up with the current summary's Total Tax Due minus Total Refunds.

6. The current year Beginning Levy Due on the year to date page should match with the total levy due from the snapshot that was ran when the current year taxroll was loaded and the levy calculated. All the other years will match up with the totals from the delinquent taxroll summary ran at that time.

Things to look for if out of balance:

1. If the Tax Unpaid column from the year to date on the month prior's recap report does not match up with the Beginning Levy Due column from the month to date on this month's recap report:

Verify the dates that the reports were run. Be sure that the starting date on the current recap is a day after the ending date on the prior month's recap. If Ending date is 01/05/2011 then the starting date for next month should be 01/06/2011.

Verify that the Year Start date is the same on both reports.

2. If the Levy Changes Additions column and Subtractions Column (from both Year to date and Month to date) does match up with the totals from the Levy Change Listing when run using the same start date and end date:

Verify that you used the same start date and end date on both reports.

Run the Levy change listing and verify that a levy did not get changed twice.

3. If the Ending levy due does not equal be the Beginning levy due plus additions minus subtractions:

Run the Levy change listing and verify that a levy did not get changed twice.

4. If the Taxes Paid column, Disc/P&I column, and Atty Fees column (from both Year to date and Month to date) does not match up with the Distribution Report when run using the same start date and end date:

Verify that you used the same start date and end date on both reports.

Verify that you ran the distribution report for "All types". The recap includes any payments, adjustments, and refunds made to tax.

5. If the Tax Unpaid column does not equal the Ending levy due minus Taxes Unpaid or if the Tax Unpaid column does not match up with the delinquent summary or the current year tax unpaid does not match up with the current summary's Total Tax Due minus Total Refunds:

Verify that no payments, adjustments, or refunds were made between running the recap and the delinquent and current summary.

Run "Convert Tax Records to Delinquency" and then rerun the Current Summary and Delinquent Summary reports.

NOTE: Payments, adjustments, refunds, or levy changes should not be made when running this report as this could affect the results.

|

| < Previous page | Next page > |