| < Previous page | Next page > |

How To... Add VIT Account

This will allow you to add an account that has monthly VIT payments.

In this space you can input all vehicle inventory amounts, taxes paid, taxes due, and specify entities to be collected that are outside your collection area.

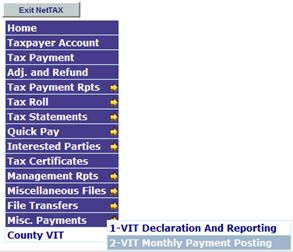

Choose "VIT Declaration and Reporting" from the Main Menu

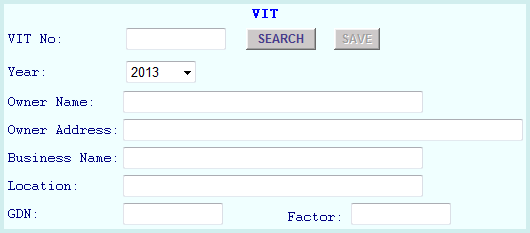

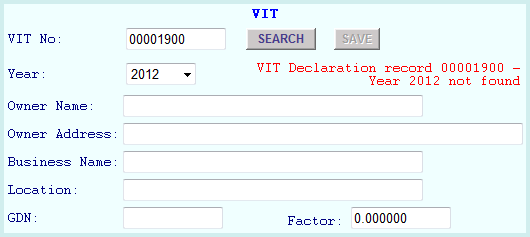

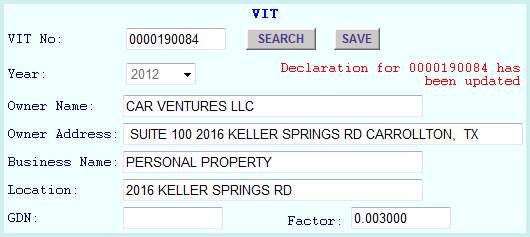

Enter VIT Number (an account already set up in your taxpayer account file) and choose the correct year from the Year drop down menu.

This will immediately find the file.

VIT does not search by Owner Name, Address at this time.

You can find the account number information in the Taypayer Account section.

After the account has been pulled up you must enter all necessary account information:

The "Entities Not Collected For" area pertains to entities that are not collected by your tax office.

Filling in this information will allocate the monies to the appropriate entities.

Entities you DO collect for are automatically allocated.

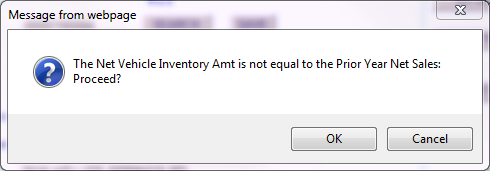

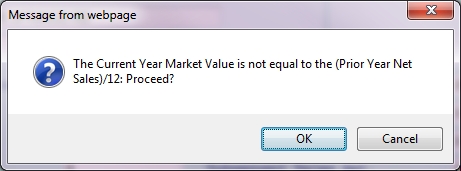

NOTE: in the area with the "Net Vehicle Inventory Units" if there are discrepencies between the "Net Vehicle Inventory Amount" and "Prior Year Net Sales", you will receive a warning message that must be cleared or canceled before you may proceed.

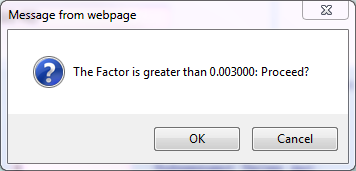

NOTE: If your Factor is greater than 0.003000 then you will receive an error that must be cleared or canceled before you may proceed.

Click "Save"

|

| < Previous page | Next page > |