|

|

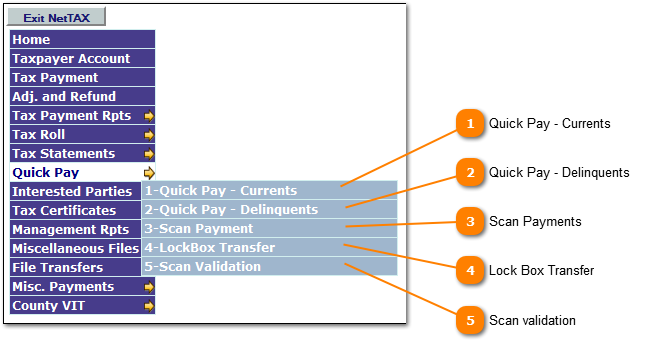

Quick pay is a series off applications which under certain conditions can greatly expedite the processing of payments in the NetTAX System.

Quick Pay - Currents

Quick Pay - Currents greatly expedites the payment of current year taxes when a single check is used to pay multiple accounts. There are several methods available for account selection including; owner name, mortgage company code, owner id. This program does not apply any penalty, interest or attorney fees. If the account is past due then use the Quick Pay - Delinquents program.

| |

Quick Pay - Delinquents

Quick Pay - Delinquents greatly expedites the payment of current and delinquent year taxes when a single check is used to pay multiple accounts. There are several methods available for account selection including; owner name, mortgage company code, owner id. This program does not apply any penalty, interest or attorney fees. If the account is past due then use the Quick Pay - Delinquents program.

| |

Scan Payments

Select this option to import payments that have been processed through a remittance processing system. Contact GDS for specific information concerning about qualified systems. | |

Lock Box Transfer

The Lock Box Transfer program provides for the entry of payments from a file provided by a "lock box" payment processor.

| |

Scan validation

Select this option to import payments that have been processed through a remittance processing system. Contact GDS for specific information concerning about qualified systems. | |

|

|