|

|

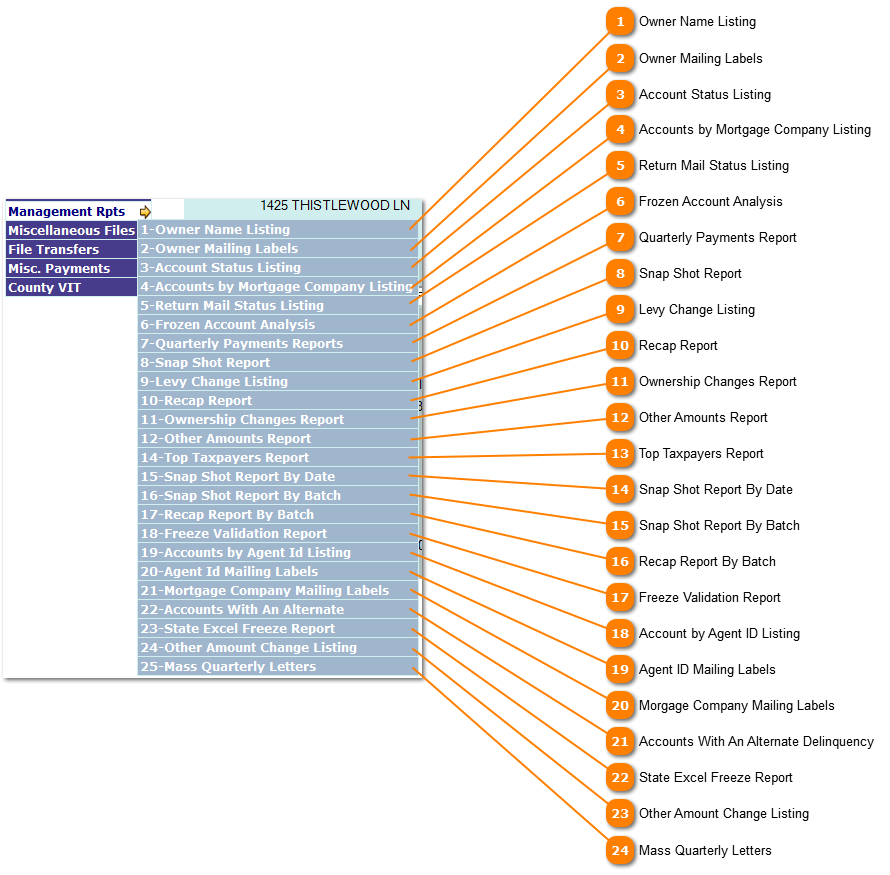

A series of reports are available on the Management Reports menu. To run a report bring up a selection screen by clicking on the selection desired.

Owner Name Listing

The Owner Name Listing prints a report on properties for a specific owner or a range of owner by name. The report is run by property type. | |

Owner Mailing Labels

The Owner Mailing Labels provides the ability to print mailing labels for specific property owners. Among other things labels can be generated off specific exemptions and/or state propterty tax code designation. | |

Account Status Listing

The Account Status Listing provides a listing of accounts based of the current account status assignment. The listing is run in Account No, PIDN or Owner Name order. Listing can be limited to a specific status or all status and whether or not taxes are due on the account. | |

Accounts by Mortgage Company Listing

The Accounts By Mortgage Company Listing provides a listing of accounts based of the current mortgage company assignment. The listing is run in Account No, PIDN or Owner Name order. Listing can be limited to a specific mortgage company or all mortgage companies. | |

Return Mail Status Listing

The Return Mail Status Listing provides a listing of accounts based of the current return mail status assignment. The listing is run by a specific Return Mail Status. | |

Frozen Account Analysis

The Frozen Account Analysis is a report that analysis the impact of frozen accounts on the overall levy for a specific tax year and tax entity. | |

Quarterly Payments Report

The Quarterly Payments Report reports on the status of accounts currently under a quarterly payments contract with the tax office. The accounts listed are sorted by account number and are listed for specfic tax year and entity. An option to print only accounts past due. | |

Snap Shot Report

The Snap Shot Report provides a view of the current status of a specifice tax year and tax entity. Included in the report is the total of all values, exemptions, tax levy and tax due. The report also breaks down the value by State Property Tax Board use codes. | |

Levy Change Listing

The Levy Change Listing provides detail by account of the changes made to the tax levy for a specific date or date range. The report can be run for a specific tax year and tax entity and is printed in Account Number, PIDN or Owner Name order. | |

Recap Report

The Recap Report provides a summary by tax year and tax entity for all changes to tax levy and tax due for a specific fiscal year and month. The report is run by beginning fiscal year date and month date or date range. Report can be generated for a single tax entity. | |

Ownership Changes Report

The Ownership Changes Report lists the before and after information for any changes made to ownership name or address fields. The report is selected by date range and can be listed in Account No, PIDN and Owner Name order. | |

Other Amounts Report

The Other Amounts Report lists what other amounts have been applied to tax records. The report can be sorted by Account No, PIDN or Owner Name and include/not include amounts previously paid. There are several other filters that can be applied to the listing including; State Property Tax Board use code or specific (upto 3 per run) other amount codes. | |

Top Taxpayers Report

The Top Taxpayers Report list the top property value owners. Multiple properties owners are combined to give a single taxpayer amount or run by individual account. The report can run based of; Total Levy, Total Value, Total Due or Total Net Taxable. The number of records desired is determined by the user. | |

Snap Shot Report By Date

The Snap Shot Report by Date, provides a view of the current status of a specifice tax year and tax entity as of a date that you specify. Included in the report is the total of all values, exemptions, tax levy and tax due. The report also breaks down the value by State Property Tax Board use codes.

NOTE: This report may take a little longer than normal Snap Shot Reports because of the type of query used.

| |

Snap Shot Report By Batch

The Snap Shot Report by Batch provides a view of the current status of a specifice tax year and tax entity as of a Batch you specify. Included in the report is the total of all values, exemptions, tax levy and tax due. The report also breaks down the value by State Property Tax Board use codes. | |

Recap Report By Batch

The Recap Report by Batch provides a summary by tax year and tax entity for all changes to tax levy and tax due for a specific fiscal year and month as of a date that you specify. The report is run by beginning fiscal year date and month date or date range. Report can be generated for a single tax entity.

NOTE: This report may take a little longer than normal Recap Reports because of the type of query used.

| |

Freeze Validation Report

The Freeze Validation Report is a report that will give you account that have an "over 65/diabled person" exemption but are not frozen, or accounts that are frozen but do not have one of those expemptions. | |

Account by Agent ID Listing

| |

Agent ID Mailing Labels

The Agent ID Mailing Labels will produce a standard mailing label file (each page with 30 labels, 3 across 10 down) for a particular Agent ID. | |

Morgage Company Mailing Labels

| |

Accounts With An Alternate Delinquency

| |

State Excel Freeze Report

| |

Other Amount Change Listing

Coming soon...

| |

Mass Quarterly Letters

The Mass Quarterly Letters function allows you to choose how to print the quarterly letters for all constituents within your office.

Choose which letters to print via the Select Page drop down. It will open a new window and create an Adobe Acrobat file with all the letters.

| |

|

|