|

|

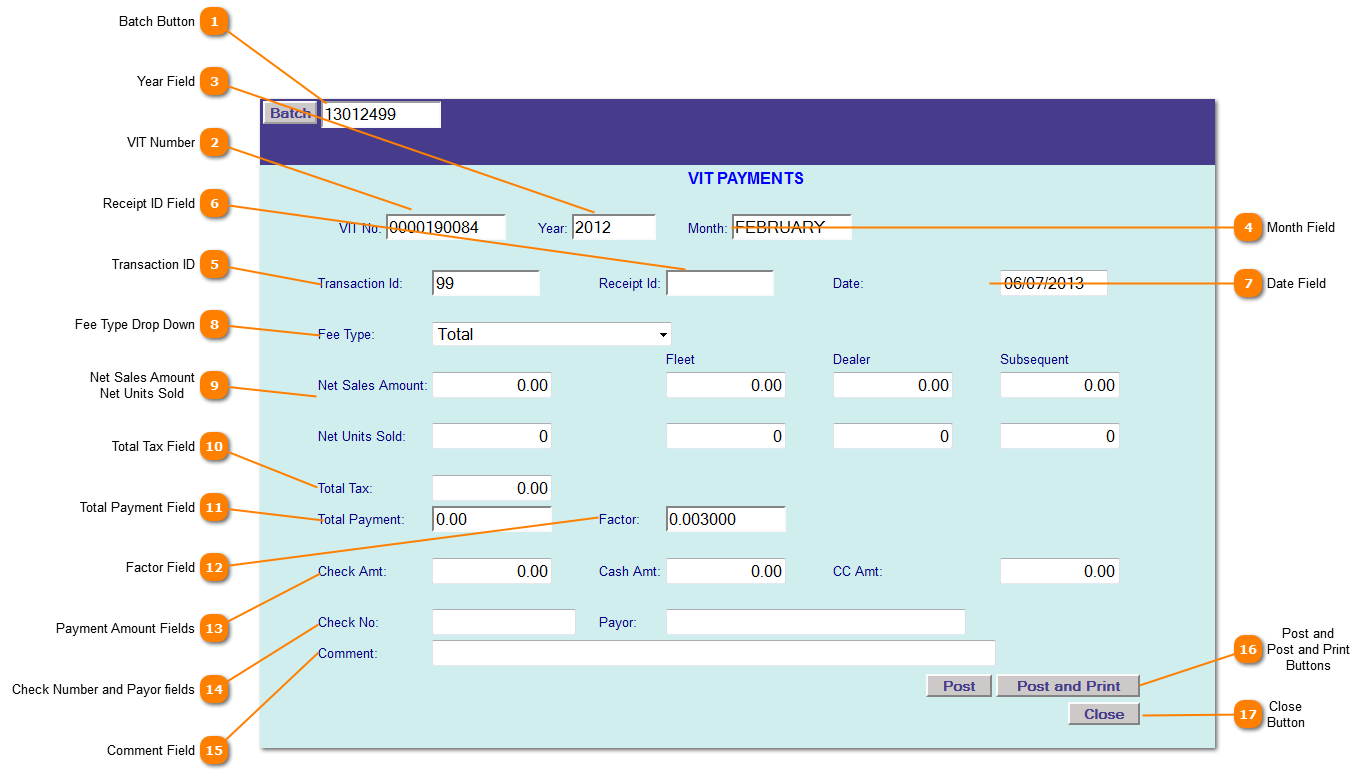

Batch Button

Create a new batch by clicking the Batch button (Batch file created or chosen will be displayed here.

| |

VIT Number

This is the VIT number that is populated by the users account information.

| |

Year Field

This is the year you chose when you brought up the VIT account information.

| |

Month Field

This is the month you chose to update.

| |

Transaction ID

A system generated (non editable) sequential number that has 1 added to it every time you post. This is necessary if you are going to make subsequent adjustments to the payment.

| |

Receipt ID Field

The Receipt ID is a data entry field for the user to put any control information in they desire.

| |

Date Field

This is the date you the payments were made, not necessarily the date that pre-populates.

| |

Fee Type Drop Down

This is where you choose which type of fees to post the payment to.

NOTE: If they are a multi faceted dealer, they must enter details under the specific type and then make an additional TOTAL entry for all the detail entries added together.

| |

Net Sales Amount Net Units Sold

Breakdown of sales (number of units sold) for this month. From State Form 50-246 step 4.

| |

Total Tax Field

This is the Total Unit Property Tax due

| |

Total Payment Field

This is the amount paid by the dealer. It can include cash, check and credit card payments.

| |

Factor Field

Initially the Factor is the tax rate that is calculated by the county at which the motor vehicle dealer will be taxed.

NOTE: This Factor amount can be changed by the dealer based on sales so they don't over or under pay their VIT taxes.

| |

Payment Amount Fields

Enter the amount of payments made here.

| |

Check Number and Payor fields

Enter any check information here

| |

Comment Field

Enter any comments here

| |

Post and Post and Print Buttons

Click to POST the payment

Click to POST and PRINT the payment

| |

Close Button

Click to CLOSE this screen. You will receive a close warning message.

| |

|

|