| < Previous page | Next page > |

How To... Add a Tax Record

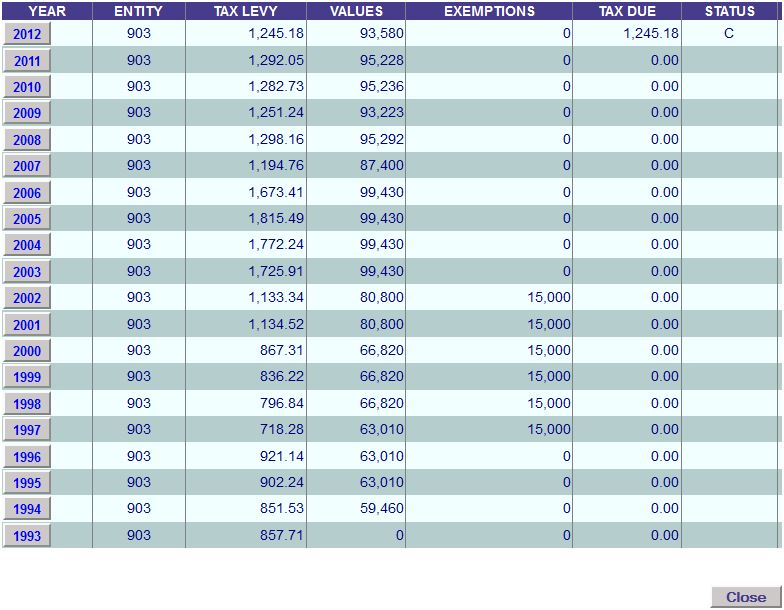

Once the Account Record is displayed, navigate to page 2 by clicking the "2" Page Selection button

To add a new Tax Record click on the “A” mode button

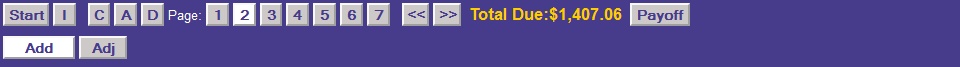

You will know you are in "ADD" mode by the "Add" button displayed in the bottom left of the Application Control Section.

Select a Year from the "Year" drop down and Tax Entity from the "Entity" Drop Down.

If the year and or entity is not an option in the drop downs than the distribution record has not been created for that Tax Year. Create the Tax Distribution Record here.

NOTE: A distribution record must be set up for each tax year and tax entity before a tax record can be added. Only one tax record is allowed per account for a specific year and entity.

NOTE: The Interest is entered as a decimal and not as a percentage (eg. 10% should be entered as 0.10).

Enter the appropriate information as required descriptions of the various data fields are available on the Tax Payer Account Records (Page 2) User Manual.

Verify that the current levy is correct. When all the information is entered, click on the “ADD”

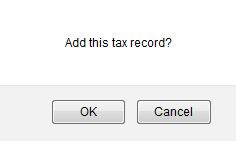

NOTE: If you are trying to create a record for an account that is already on file, this error will appear at the bottom of the screen.

At any time, the “I” button

|

| < Previous page | Next page > |