GDS NetTAX Help System

Main Menu

Tax Payer Account

Miscellaneous Files

NetTAX How To...

How To... Miscellaneous Payments

| < Previous page | Next page > |

How To... Mobile Homes

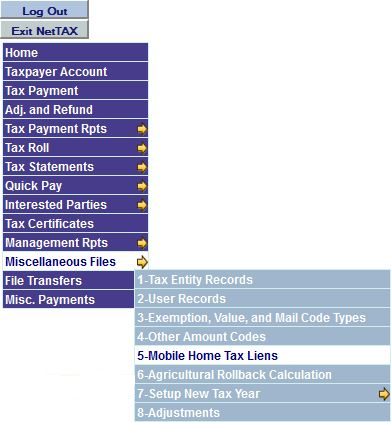

User Records can be accessed by selecting "Mobile Home Tax Liens" from the "Miscellaneous Files" menu from the main menu.

This program is used to maintain Mobile Home tax lien records for the creation of the state mobile home tax lien file that is emailed to the state. This file can be emailed to taxlien@tdhca.state.tx.us and is due by midnight on June 30th.

NOTE: These records must be maintained manually. The liens must be entered into the system when the tax record's become delinquent. When a payment is made, you will need to return here to enter the release date for the tax record. It is also helpful to enter the letter "T" in the account status to mark this account as a mobile home. You can then run reports based upon this status.

|

| < Previous page | Next page > |