| < Previous page | Next page > |

How To... Make a Quarterly Payment

NOTE: When making a quarterly payment on an account that also has delinquents, the delinquents and the quarterly payment must be made separately. When entering the delinquent portion of the payment, change the calculation method from "QUARTERLY" to "STANDARD". For the check amount, enter the amount that is being paid on the delinquents. The remainder will be the amount that will be paid on the quarterly when making the quarterly payment. The 2 amounts will then add up to the total check amount.

Note: “Quarterly” will automatically be selected if the tax record is marked as quarterly.

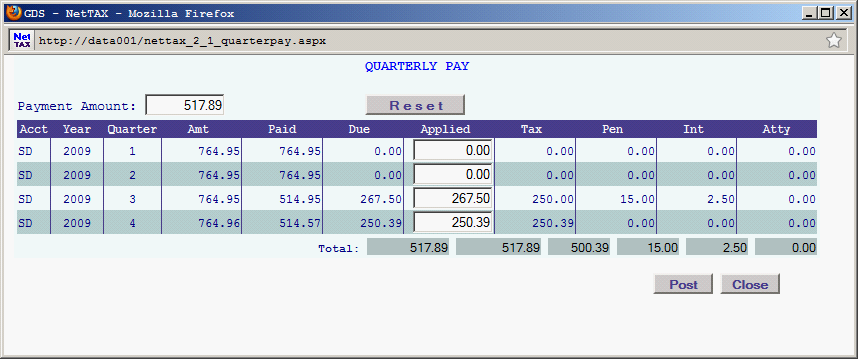

After clicking on the “POST” or “POST AND PRINT” button, the following quarterly payment screen will appear:

Note: Clicking the Reset

Enter the amount paid under “applied” for each quarter.

NOTE: The system will apply the payment to the current quarter and anything left over will be applied to previous unpaid quarters. The amounts can be changed by entering the correct amounts under “Applied” for each quarter.

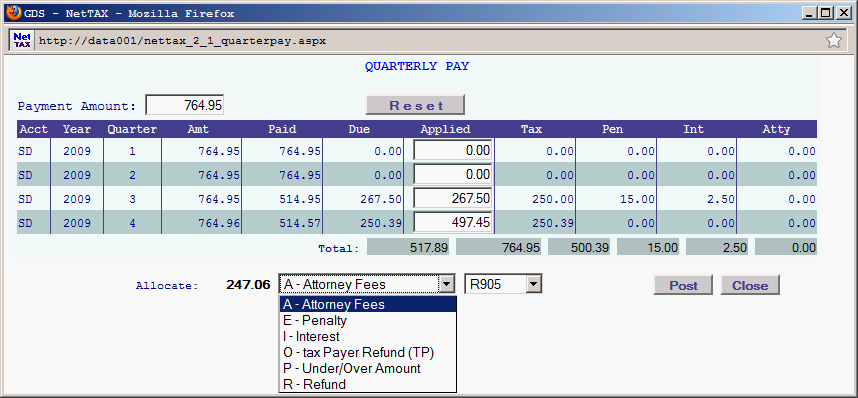

If the fourth quarter is overpaid, then the overage amount can be applied to attorney fees, penalty, interest, taxpayer refund, or under/over amount.

NOTE: The payments on the first, second and third quarters can not be allocated.

|

| < Previous page | Next page > |