| < Previous page | Next page > |

How To... Change a Tax Record

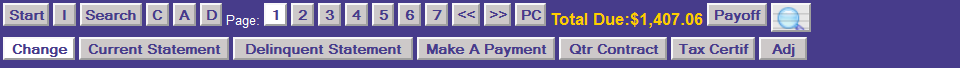

You will know you are in "CHANGE" mode by the "Change" button displayed in the bottom left of the Application Control Section.

Using the mouse or tab key move to the field that needs to be changed.

NOTE: The Interest is entered as a decimal and not as a percentage (eg. 10% should be entered as 0.10).

To add or change values and exemptions chose the type from the Values drop down or Exemption drop down and input the dollar amounts. The Total Value, Total Exemption, Taxable Value, Current Levy and Taxes Due are calculated by the system.

A Current Levy other than what the system calculates can be entered by overwriting/entering the levy amount in the current levy position..

When all changes have been made, click on the "Change" mode button

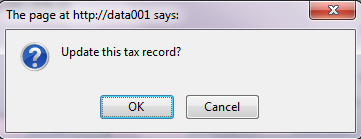

The system prompts:

Click "OK" to update this record as changed or "Cancel" to return to the Taxpayer Tax Records Screen.

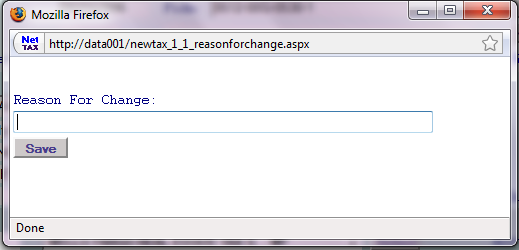

Clicking on "OK" to update this record the system prompts:

Enter the reason for making this change. The NetTAX system maintains a description of changes made to records along with the date and the user who made the change. Click the "Save" button to record the change.

To abort this change and revert the record to it's original data, simply click the "I" mode button to change to inquiry only mode or click "Start" button to search start a new record search.

If the record was successfully updated system will prompt at the left bottom of the screen:

|

| < Previous page | Next page > |