|

|

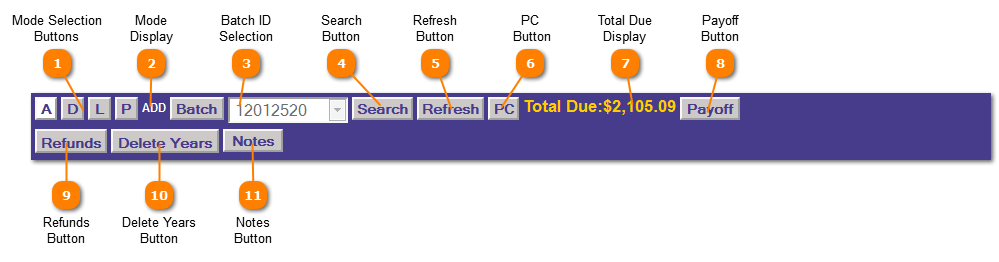

Adjustments and Refunds | Application Control Section

Mode Selection Buttons

The Mode Selection determines which mantenace mode the program should enter.

A = Add

D = Delete

L = List

P = Post

| |

Mode Display

Mode display instructs the user if they are in Add or Delete mode.

| |

Batch ID Selection

Select a Batch ID from the drop down list or create a new batch by clicking the "Batch Button". The Batch ID selected remains with the user until the current session has ended or the Batch ID is changed.

A valid Batch ID must be selected before adding, deleting, listing or posting adjustments.

| |

Search Button

Click the "Search" button to search for possible candidates based on the information selected.

| |

Refresh Button

Clicking the "Refresh" button clears the screen for entry of a new account.

| |

PC Button

Clicking the Possible Candidates button brings up the pop-up to display the accounts which met the selection criteria.

| |

Total Due Display

The Total Due Display provides the total due on this account using system default parameters

| |

Payoff Button

Click the "Payoff" button displays the breakdown of the Total Due Display (below).

| |

Refunds Button

The "Refunds" button enters the application into process refunds mode.

| |

Delete Years Button

The "Delete Years" button prompts for tax year information to remove records from the tax roll.

| |

Notes Button

The "Notes Button" will bring up a pop-up screen with page 5 of the Tax Payer Account screen so you can add any notes you deem necessary.

| |

|

|