GDS NetTAX Help System

Main Menu

Tax Payer Account

Miscellaneous Files

NetTAX How To...

How To... Miscellaneous Payments

| < Previous page | Next page > |

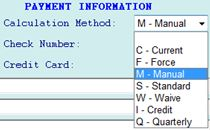

How To... Make a Manual Payment

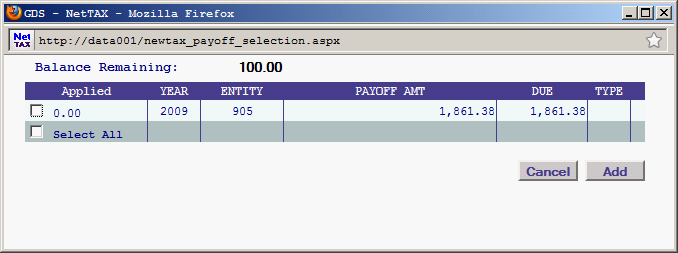

After clicking on the “POST” or “POST AND PRINT” button, select the year and entities that are to be paid.

After selecting the line items to pay click on the “ADD” button.

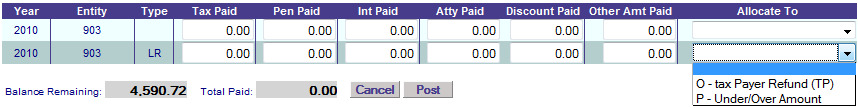

Enter the amount of taxes, penalty, interest, and attorney fees paid.

If the payment is either over paid or underpaid, you can allocate the amount/difference to either Taxpayer Refund or to Under/Over.

When finished, click on the POST button.

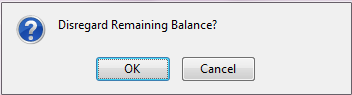

NOTE: If there is a balance remaining (meaning that the Tax + Penalty + Interest + Attorney - Discount + Other Amount Paid does not equal the check amount) after clicking on the POST button, the system will ask if you want to disregard the remaining balance. Click on OK to only post what was entered or CANCEL to correct any figures that were entered incorrectly.

|

| < Previous page | Next page > |