| < Previous page | Next page > |

How To... Early Attorney Fees on Personal Property (HB2491)

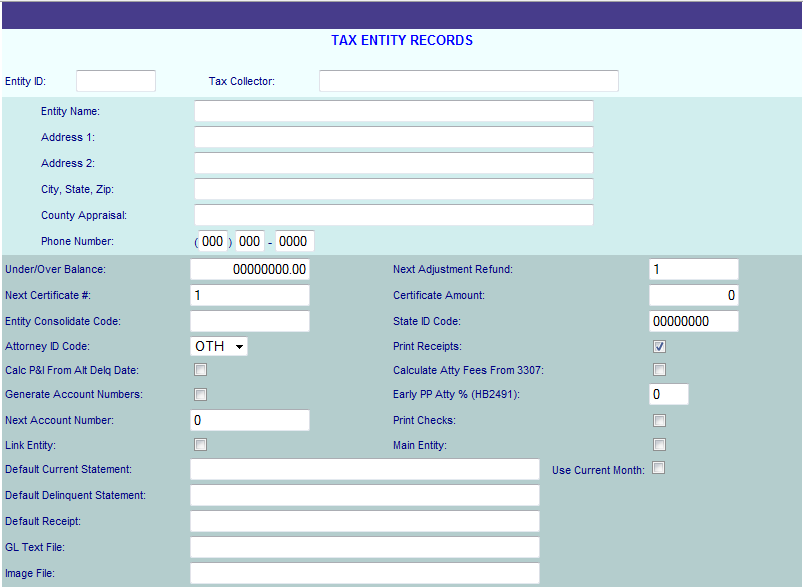

If it has been decided between your attorney's and your entity to start collecting early attorney fees on personal property, then go to Tax Entity Records and change "Early PP Atty % (HB2491)" to the percentage that the attorney's charge for each entity record.

Remember:

1. If you have already run your statements for October before changing this field, the personal property account statements will have the wrong amounts for the April, May, and June payoff amounts. These amounts do not include the attorney amount.

2. If the current year is 2010 and the agreement has been made but doesn't take affect until April 2011 (2011 current year), then DO NOT CHANGE this field until after July 2010. If you change this before July 2010, then this will affect the personal property for the 2010 tax year.

3. The delinquent statements will print the 3301 notice for non personal property accounts and the 3311 notice for personal property accounts.

4. Some Appraisal Districts flag Mobile Homes accounts with an "M" for the Property type. These are not considered as personal property. Mobile home accounts can either be personal property or real property. If your attorneys want the personal property mobile home accounts to collect the attorney fees early, you will need to go into each account and change the Property Type from an "M" to a "P" and this will need to be done each year after the current taxroll roll is loaded from the appraisal district and before the first statements are printed. To make this process easier each year, it is suggested that you decide on a unique account status to use so that you can get a listing of these accounts to go by each year.

5. Mineral accounts ("N" in the property type) are not considered as personal property. Most appraisal districts will flag the Mineral accounts that are personal property as personal property ("P" in the property type). If this is not the case then you will need to go into these accounts and change the property type to a "P" as well. See #4 above.

If your attorney percentage is 20%:

6. If the payoff date is February or March of the current year and attorney fees are being forced onto the account, then by law for these 2 months the attorney fee percentage is 15% and not 20% for the current year.

|

| < Previous page | Next page > |