| < Previous page | Next page > |

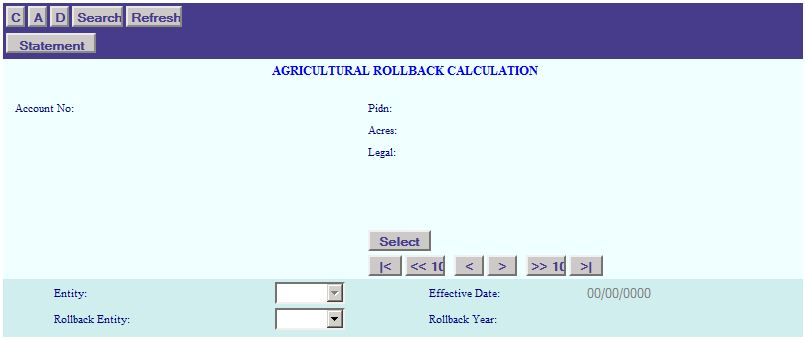

How To... Add an Agricultural Rollback

Click on the “A” in the application control section to enter the “ADD” mode. Enter the Account Number, or PIDN.

NOTE: Select/Enter the account that will be receiving the rollback statement.

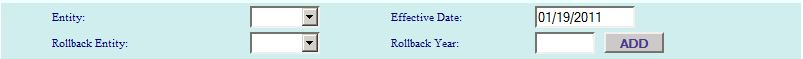

Select the Entity, Effective Date, Rollback Entity, and Rollback Year.

Select the "Entity" to be rolled back.

NOTE: If you do not have an Agricultural Rollback Entity setup, then go to "Tax Entity Records" and add the rollback entity. The 2 most common entity codes for the Rollback entity is either "RB" or put an "R" in front of your entity code (e.g. "R901"). You will then need to go and setup the distribution table for the entity (See "How To... Add a Distribution Record").

Enter an "Effective Date". The Effective Date is referred to as the change of use date, the date the property was sold, the date the Agricultural Exemption was removed or the date worked.

Choose the "Rollback Entity" for the above selected Entity. (The Rollback Entity will typically have an "R" in front of the entity code.

Enter the "Rollback Year". The Rollback Year will be the last year being rolled back plus 1.

e.g. - if the years being rolled back are 2005 - 2009, the rollback year will be 2010.

After entering all the information, click on the “ADD” button to continue.

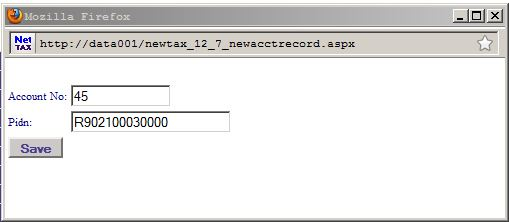

NOTE: If this window pops up:

This means that there is already a rollback record on this account for this year and entity. This window is giving you an opportunity to enter a new account number and a new PIDN. The PIDN displayed is the PIDN for the original account. Enter a "-A", or a "-RB" at the end of the PIDN to make unique. Take note of the account number, as this will be the new account for the rollback property. This new account will have all the same property information as the original.

Click on the "SAVE" button to create the new property record.

If you get a message that says, " The Distribution Table does not have a rollback entity for XXXX and year 9999 on file.", then go to Distribution Table Records to set up the year and entity.

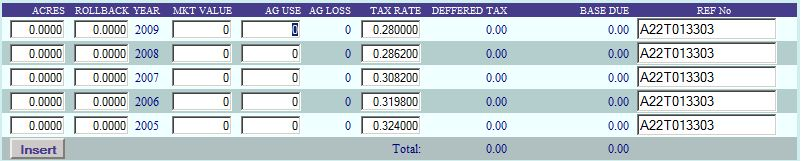

Enter the Acres, Rollback Acres, Market Value, AG Use Value, Tax Rate, and Reference No.

NOTE: Acres is the total acres for the property for that year.

Rollback Acres is the amount of acres being rolled back.

Market Value is the market value on the total acres for this property for that year.

AG Use is the AG Use value on the total acres for this property for that year. AG Use is sometimes referred to as the taxable value for the AG property.

AG Loss equals Market Value minus AG Use.

Tax Rate is the Tax Rate for that year on this Entity.

Reference No. is usually the property ID No. for this rollback. You can also enter an account No. for a parent account to this rollback. This is just used as a reference.

If an agricultural rollback year did not have an agricultural deferral, then enter 0's for that year.

When finished click on the "INSERT" button.

The system will then prompt:

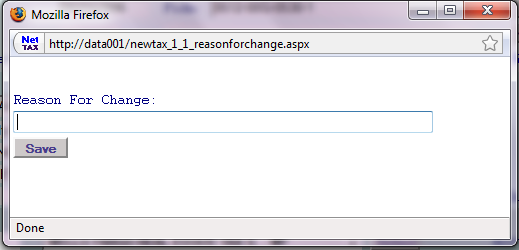

Enter the reason for making this change. The NetTAX system maintains a description of changes made to records along with the date and the user who made the change. Click the "Save" button to record the change.

Click on the "Statement" button in the application control section to print an Agricultural Valuation Rollback Statement.

|

| < Previous page | Next page > |