GDS NetTAX Help System

Main Menu

Tax Payer Account

Miscellaneous Files

NetTAX How To...

How To... Miscellaneous Payments

| < Previous page | Next page > |

How To... Allocate Under/Over Payments

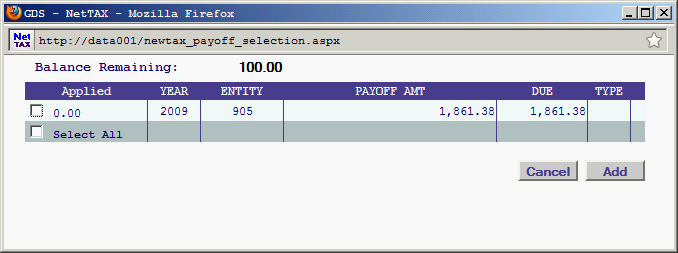

If the cash + check + credit card amounts do not equal the payoff amount, the following screen will come up to select the year and entities to pay.

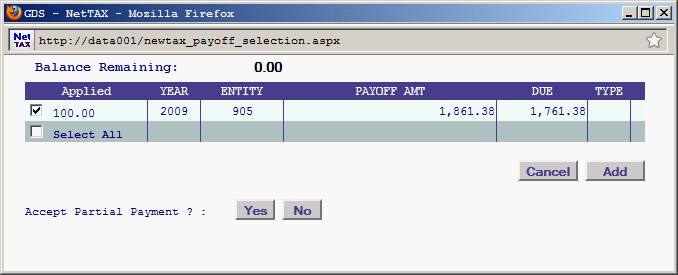

After selecting the line items to pay click on the “ADD”

Click on the “No”

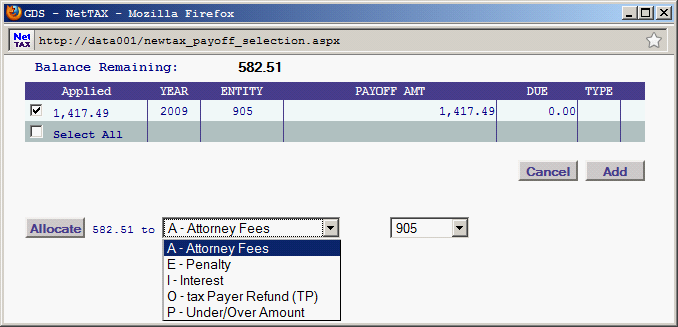

Select a valid allocation from the drop down menu and then click on the “Allocate”

You will be taken back to the Payments screen.

|

| < Previous page | Next page > |