|

|

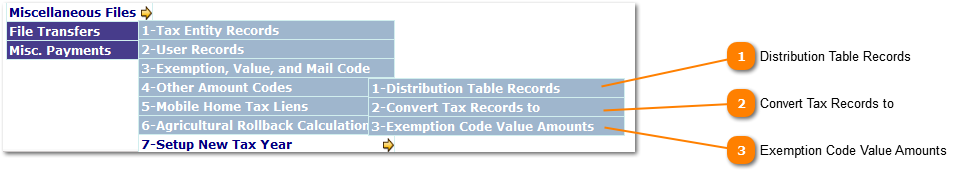

Setup New Tax Year contains the programs required to setup a new tax year.

-

Distribution Table Records, sets up the tax rates, Maintenance and Operations, Bond Funds, Assessment Ration and Discounts.

-

Convert Tax Records to Delinquency moves all current records to a "D" Tax Status.

-

Exemption Code Value Amounts allow default entry of dollar amount and calculations for exemptions.

Distribution Table Records

The information is contained on two pages (Previous Side and Next Side).

| |

Convert Tax Records to

The "Convert Tax Records to" performs tax record maintenance and changes the tax status from the "C" current status to "D" delinquent status.

This program maybe run at any time.

| |

Exemption Code Value Amounts

The Exemption Amounts allows for the entry of a default amount of calculation method for specific exemptions.

| |

|

|