GDS NetTAX Help System

Main Menu

Tax Payer Account

Miscellaneous Files

NetTAX How To...

How To... Miscellaneous Payments

| < Previous page | Next page > |

How To... Enter a Mobile Home Escrow Payment

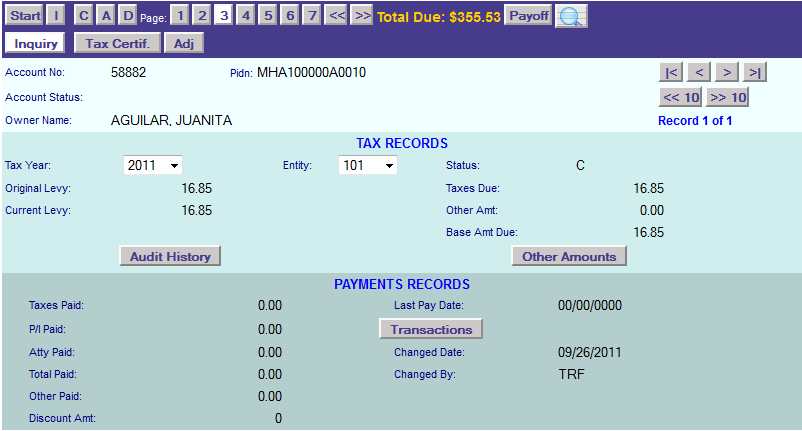

Before the escrow payment can be entered, the escrow record on the account needs to be setup. Go to page 3 of the account and then click on the

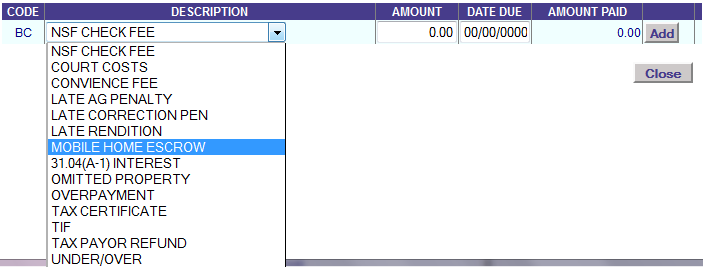

Select the Mobile Home escrow from the drop down and then enter the amount of the payment. Click on the

You can now go to "PAYMENTS" to apply the payment.

NOTE: It is a good idea to keep a list of theses accounts so that when the new tax year is added to the database, these escrow payments can be "Refunded" and then applied to the new tax year.

After making the payment, 1 of 2 things can then be done (1 is the preferred method):

1: Go back to page 3 and zero out the amount on the Mobile Home Escrow. This will then show a refund on the account due to the escrow payment. You can then get a list of all the mobile home escrow payments waiting to be applied to the new tax year or a list of all the escrow payments.

2: Do nothing. The account will then show as being paid in full. You can then get a list of all the mobile home escrow payments on file, whether applied to the new year or not.

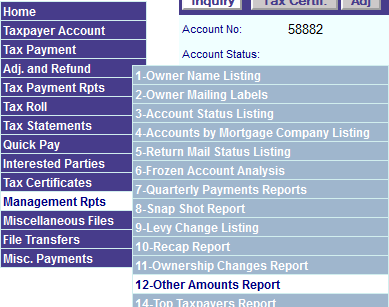

To get a list, go to Management Rpts and then 12-Other Amounts Report.

|

| < Previous page | Next page > |