| < Previous page | Next page > |

How To... Freeze Reports

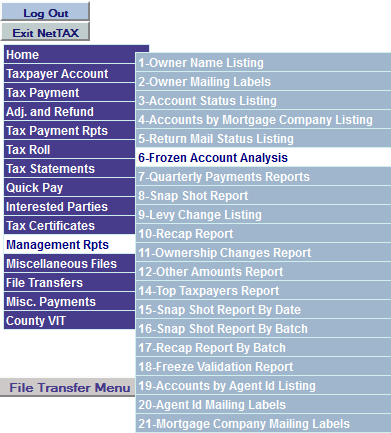

Frozen Account Analysis can be accessed by selecting "Frozen Account Analysis" from the "Management Reports" menu off the main menu.

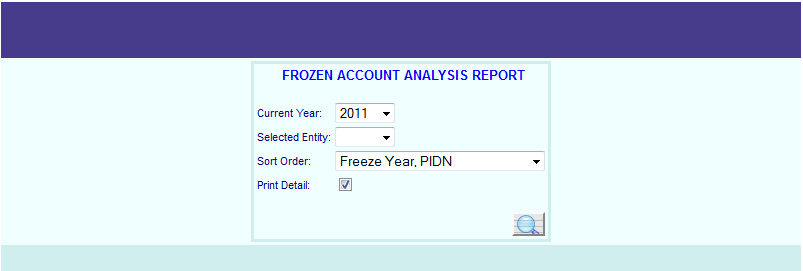

Select the year that you want to use for the frozen account analysis.

Select the entity that you want to use for the frozen account analysis. An entity must be selected.

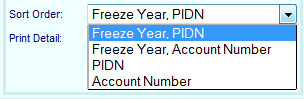

The frozen account analysis can be sorted in 1 of 4 ways: "Freeze Year, PIDN", "Freeze Year, Account Number", "PIDN", or "Account Number". The last 2 options, "Frozen Accounts Existing and Frozen in 2006" and "Frozen Accounts Existing and Frozen in 2006 Using Pre HB5 Frozen Amounts", are special reports and will be sorted in "Freeze Year, PIDN" order:

"Frozen Accounts Existing and Frozen in 2006"

This report selects only the accounts that were frozen in 2006 or before and that are still currently frozen. This will give you the amount of the levy lost for just these accounts using the Current Year frozen amount.

"Frozen Accounts Existing and Frozen in 2006 Using Pre HB5 Frozen Amounts"

This report selects only the accounts that were frozen in 2006 or before and that are still currently frozen. This will give you the amount of the levy lost for just these accounts using the 2006 frozen amount (Pre HB5).

If you take the levy lost from the "Frozen Accounts Existing and Frozen in 2006 Using Pre HB5 Frozen Amounts" and subtract the levy lost from the "Frozen Accounts Existing and Frozen in 2006", the result will be the amount of levy that was lost due to the passing of House Bill 5.

Check this box if you want a detail listing of of the selected accounts and the summary page or leave unchecked for just the summary page.

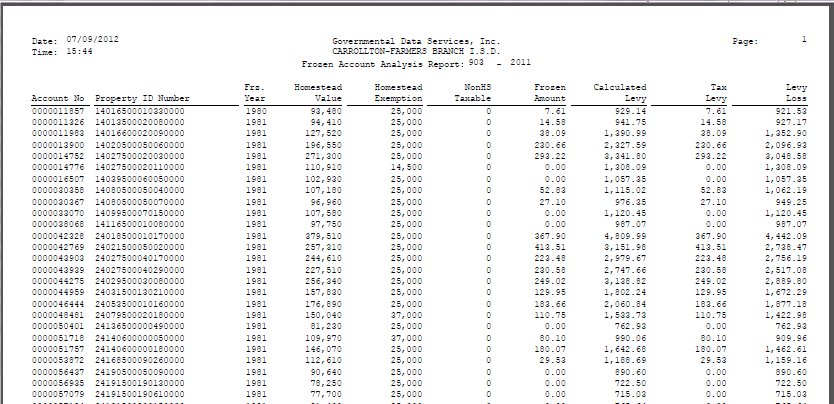

NOTE: The Column "Homestead Value" refers to the values that are considered as part of your residence homestead. The Column "Homestead Exemption" refers to the exemptions that are considered as part of your residence homestead.

Sample Detail:

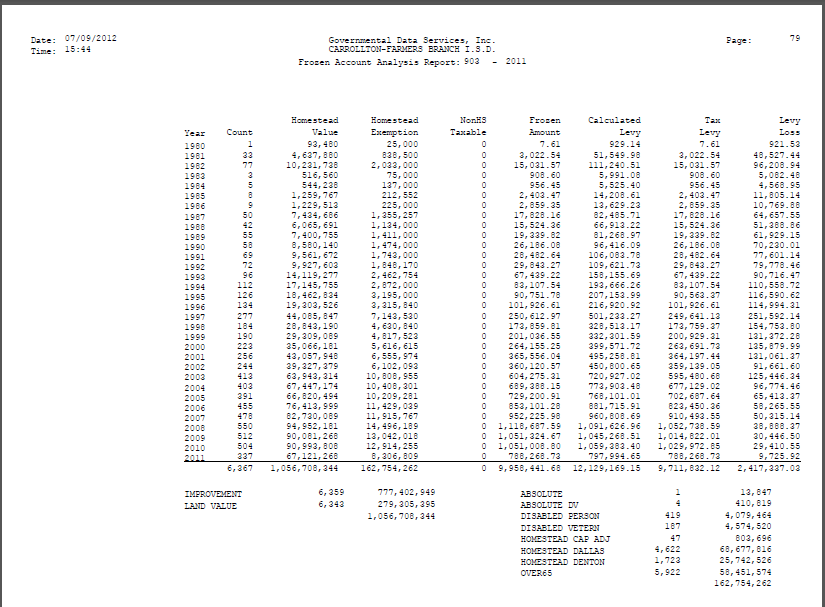

Sample Summary:

|

| < Previous page | Next page > |