| < Previous page | Next page > |

How To... Process Credit Card Payments

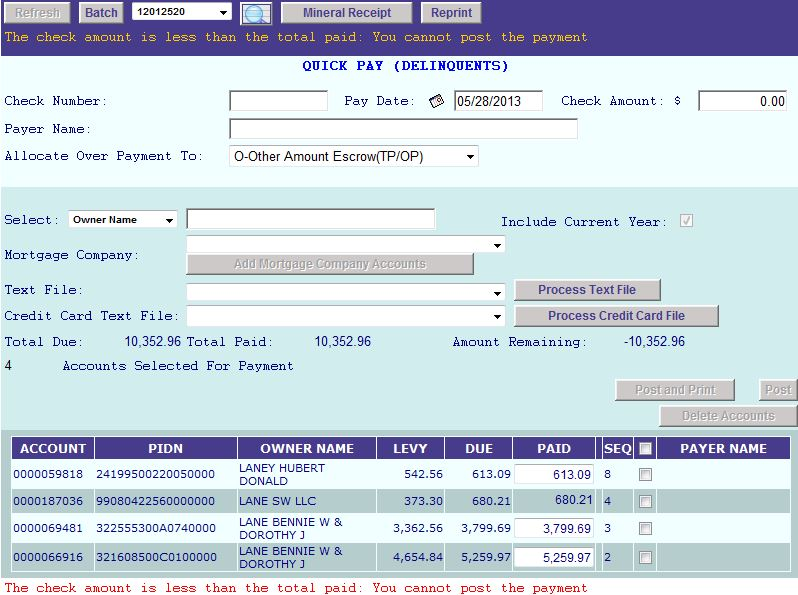

NOTE: You no longer have to do this in order. Now you can search for the accounts before you enter the amount and date informaiton, but you must have all the information filled out before you can POST the payment.

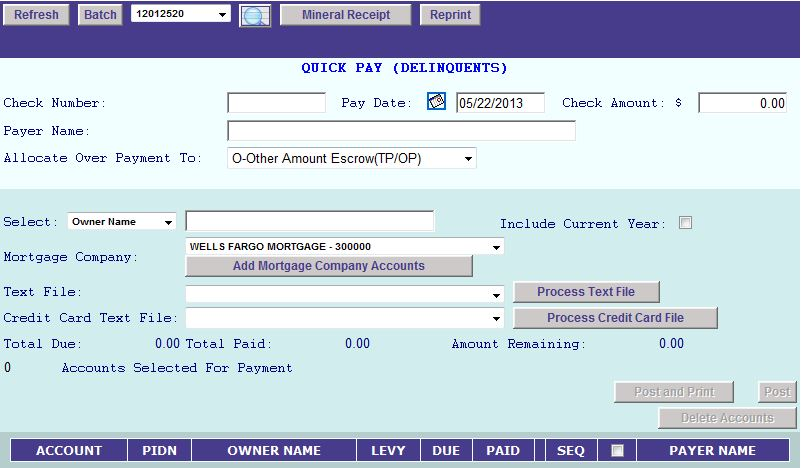

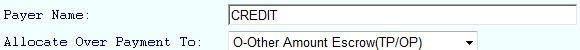

Select from the "Allocate Over Payment To:" drop down where to allocate any over payments that might occur.

O – Other Amount Escrow (TP/OP) to apply the overage to Other Amounts

T – Tax payer refund will apply the overage to the base tax where other amount escrow will allocate the overage to other amounts.

Search for the accounts to be paid by entering the appropriate fields:

You can search for an indvidual account by Account Number, PIDN, Owner Name or Owner Id. You can also search for multiple accounts by choosing a mortgage company from the Mortgage Company drop down and clicking the "Add Mortgage Company Accounts Button"

NOTE: The "Include Current Year" check box will include current year taxes.

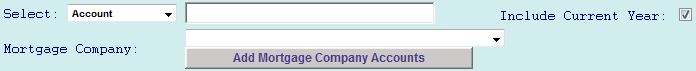

Choose the account(s) you wish to pay. If you paying multiple accounts ensure only the accounts you are paying are listed.

NOTE: There may be too many accounts listed or you may need to start over. To do this see Delete Account.

NOTE: The error you see at the bottom will occur if you have not yet filled out the information at the top of the screen. You will not be able to POST this payment without that information being completed properly.

Select the Credit Card Text File from the drop down list and then click on the "Process Credit Card File" button.

If there are any payments that need to have a different Pay Date, delete that account from the list and then post seperately.

Verify that the total paid matches the check amount entered (see above).

If they do not match or there is a message displayed under the account list, then compare the list with the credit card report that was emailed to you.

NOTE: Possible errors are that there are no taxes due for this account, processing a file that has already been processed, or no payments to be made.

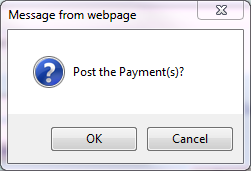

Click on the "Post and Print"

Click OK when the confirmation screen appears.

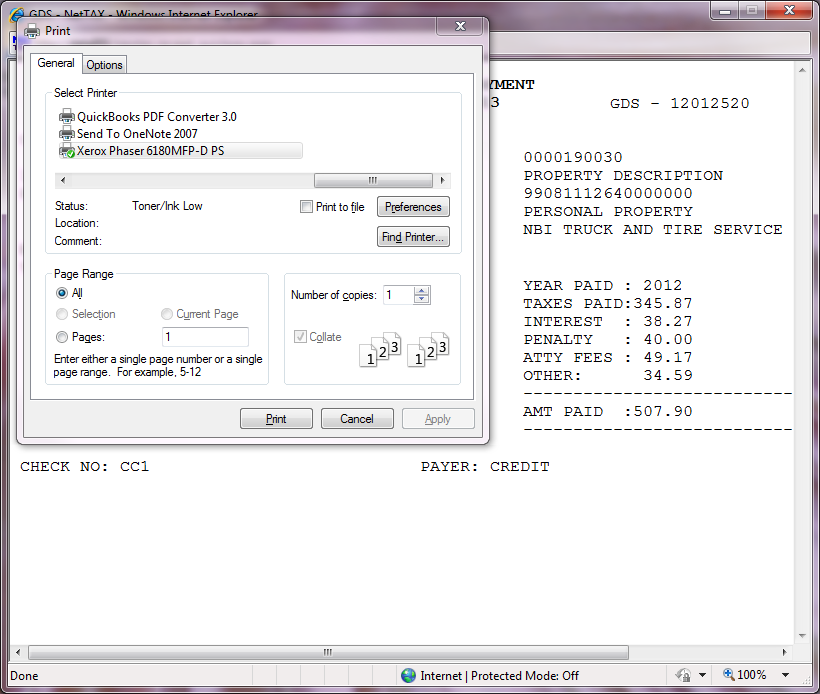

POST AND PRINT

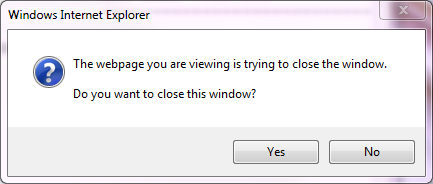

If you chose POST AND PRINT get this screen click NO.

You will be prompted to Print this PDF.

|

| < Previous page | Next page > |