|

|

The Current Year 3307 program prints statements for accounts that are past due. The Current Year 3307 Statement screen provides the ability to print various runs using the most common parameters to meet processing needs.

Current Year 3307 Statements create a file in "pdf" file format (Adobe Reader). There is a limitation of approximately 8000 pages per run.

Sort By

Drop Down

The Sort By drop down lists the options available for ordering the report. Which ever order is chosen the

| |

Select Year

Drop Down

To limit the delinquent statement run to only include accounts which have taxes due for specific year, select that year from the Selected Year drop down. Leave as blank to select all accounts with taxes due regardless of year.

| |

Selected Entity

Drop Down

To print delinquent tax statements for a single entity, select the entity from the Selected Entity drop down. Leave as blank to print statements for all entities regardless of the tax entity.

| |

Property Type

Drop Down

To limit the printing of delinquent tax statements to include only records of a specific property type select that type from the Property Type drop down. Leave as "All Properties" to print statements for all accounts regardless of property type.

| |

Selected Status

To print delinquent tax statements for accounts that include specific account status codes, enter the desired status code(s). Leave as blank to select accounts without regard to the account status code.

| |

Skip Status

To exclude accounts to print delinquent statements of a specific account status enter those status codes here. Leave blank to include accounts regardless of status code unless you select specific status codes above.

| |

Skip Mail Code

To print delinquent tax statements for accounts that have a specific return mail code, enter the desired return mail code. Leave as blank to select accounts without regard to the return mail code.

| |

Start Month

Drop Down

Select the month the statements are to be mailed. This is where the penalty, interest and attorney fee calculations will begin. Multiple months due are printed on the statement. This is the first month.

| |

Use Agent Address

Check Box

To use the address for the billing agent instead of the property owner, click the Use Agent Address check box. This only pertains to accounts that have a billing agent on file for the account. This box left unchecked prints all Delinquent Statements to the property owner.

| |

Force Atty Fees

Check Box

Accounts that have a "S", "L" or "I" in the account status will force attorney fees on the amount due if this box is checked.

| |

Include Billing Agents

Check Box

To include accounts that have a billing agent on file check the Include Billing Agents check box. Leaving this box unchecked will skip all accounts that have a billing agent on file.

| |

Included Mortgage

Companies Check Box

To include accounts that have a mortgage company code on file check this box. Leaving this box blank will exclude accounts with a mortgage company from this run.

| |

Print 3307 Notice

Check Box

To print the 3307 legal narrative on the delinquent statement, check the Print 3307 Notice check box.

| |

Print Statement Summary

Check Box

To print a statement summary of what was run and how many statements where generated check this box. The summary is printed on the last sheet once all the statements have been printed.

| |

Print All Del...

Check Box

Check this box to include all delinquents taxes on this statement even if a specific entity and/or year has been selected above. Leaving this box unchecked the statement will only include taxes for the specific entity and/or tax year selected.

| |

Skip Minerals

Check Box

To skip accounts of a property type mineral check this box. Typically minerals are printed on as a separate run and on a different format.

| |

Include Current Year

Check Box

To include the current year on the delinquent statement check the Include Current Year check box. Leaving this field unchecked will not print current year taxes on the delinquent statement from Sept - June of the current tax year.

| |

Use Aleternate Delinquency Date

Check this box and input the date for Alternate Delinquency Calculations.

| |

Minimum Amount Input box

<TODO>: Insert description text here...

| |

Data Range:

Start and End Field

The Start Field and End Field limit the statements printed based off the Sort By field selected above.

If owner name is selected and all accounts are desired leave the Start Field blank and fill the End Field with several Z's.

For a specific owner name enter the full name in both fields.

For zip code runs enter in zip+4 format with no hyphenation (762480000).

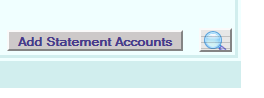

Sort order "Selected Account Numbers" provide the entry of individual accounts to print. Once selected the "Add Statement Accounts" button shows at the bottom right just before the Generate Report button.

Click the "Add Statement Accounts" button to display the popup:

Enter the desired Account No or Pidn No for the accounts to print statements for. Once all desired accounts are entered click the Generate Report button (Magnifying Glass) to display the delinquent statements in "pdf" form for printing. Click the "Close" button to end.

| |

Report Name

Report Name is the statement form used for the delinquent statement. The default system delinquent statement form is displayed.

| |

Generate Report

Clicking Generate Report magnifying glass creates the Delinquent Tax Statements based of the parameters entered, in a "pdf" format..

| |

|

|