|

|

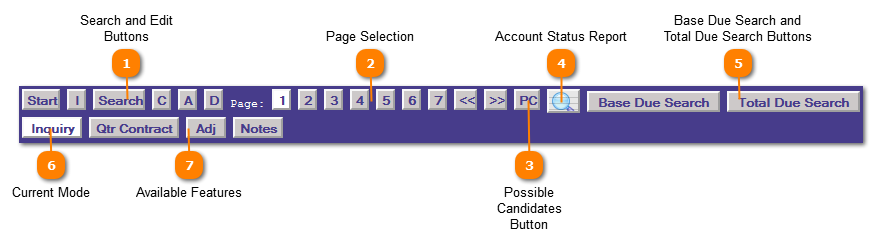

Tax Payer Account | Application Control Section - Search By

Search and Edit Buttons

The Start button  resets page one, clears the memory and prompts to locate a specific account record. Control is passed to the Account No: field.

Pressing the Inquiry button  places the application in "inquiry" mode. No changes can be made to the account while in inquiry mode.

Press the Search button  to begin searching for an account based on the information entered.

The Mode Selection  determines which maintenance mode the program should enter.

C = Change

A = Add

D = Delete

| |

Page Selection

Once a Tax Payer Account has been selected access to one of the 7 basic data screens can be accessed by pressing the appropriate button.

The Tax Payer Account records7 basic data screens are:

1 = Owner and Property Information

The Page Navigation buttons  can be used instead of the Page Selection buttons by clicking the arrow to the move the application to the desired page. | |

Possible Candidates Button

The PC or Possible Candidate button is used to return to the pop-up screen when multiple account records matched the search criteria entered. The original search selection is maintained until the "Start" button is pressed to clear the memory for a new search. For example if the name "Miller" was entered in the name field every account with the name beginning with Miller displays on the Possible Candidates popup.

| |

Account Status Report

The Account Status Report button brings up report of the current status of the account. This report has been useful to provide a quick print of any taxes that are due on the account with 3 months payoff amount.

When Account Status Report is selected a popup prompts for additional information, change the information and or press the magnifying glass to print the Account Status Report.

If the account has taxes due the Total Due displays which includes; taxes due, penalty, interest, attorney fees and other amounts. The amount is based off the system date. Pressing the "Payoff" button displays the details of the the Total Due with some additional options for recalculation including; different payoff date, specific tax entity, specific year, force attorney fees (current year taxes), consolidate (all entities one payoff line per year) and whether to include Other Amounts.

| |

Base Due Search and Total Due Search Buttons

The Base Due Search button  will allow you to search for accounts that have an amount due by searching for a specific range of number.

Note: The difference between Base Due and Total Due searches is the total due will bring up the total amount due for a client for all years and entities whereas base will only search for the current amount due.

For example:

-

If you want to find all the accounts with $100 due, you would enter 100 in the search field and the results will pop up in a new window having all accounts with an amount due between $100 and $100.99.

-

If you want to have a broader search you can input a range to search thru, for example if you search "100-200" the results will return all accounts with an amount due between $100 and $200.99.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------

The Total Due Search button  will allow you to search for accounts that have an amount due by searching for a specific range of number.

Note: The difference between Base Due and Total Due searches is the total due will bring up the total amount due for a client for all years and entities whereas base will only search for the current amount due.

For example:

-

If you want to find all the accounts with $100 due, you would enter 100 in the search field and the results will pop up in a new window having all accounts with an amount due between $100 and $100.99.

-

If you want to have a broader search you can input a range to search thru, for example if you search "100-200" the results will return all accounts with an amount due between $100 and $200.99.

| |

Current Mode

The Current Mode button indicates which Mode Button was selected. Possible Current Mode Displays are:

"Change", "Add", "Delete" and "Inquiry".

Press the Mode button while in "Change", "Add" and "Delete" mode to perform the operation.

| |

Available Features

The Available Features is an automatic display programs that are directly accessible for this account based off the information contained in the accounts. Direct access to the feature is available by clicking the desired application.

Current Statement = Prints a Current Statement for the account selected if current taxes are due on the account.

Adj. = Adjustments and Refunds

Notes = Displays in popup and allows for the creation of note records that pertain to a particular account. Date the note was created, who created teh note, the note status and comment information.

| |

|

|