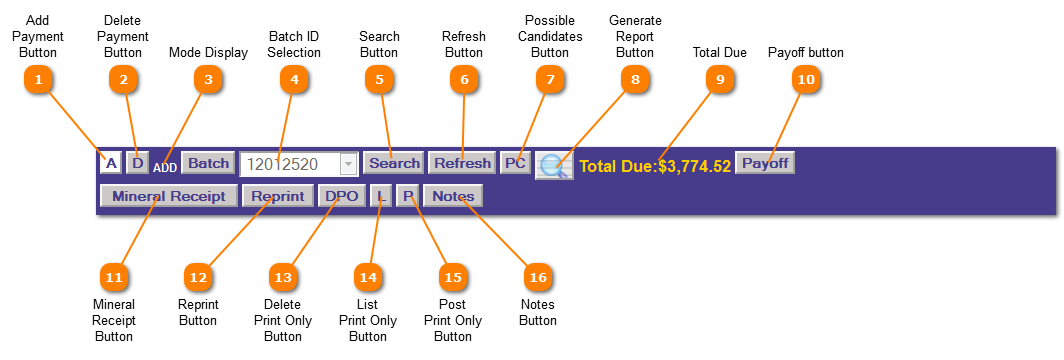

Tax Payments | Application Control Section

The Application Control Section is where all functions and features are accessed.

Information in this section will change depending on the information the account which has been called up.

For example: If taxes are due on the account the amount due (including and penalty, interest, attorney fees and other amounts) will be displayed in the upper right hand corner.

Add Payment Button

Once a valid batch-id has been selected click the Add Button to add a new payment.

Control is then passed to the Account Owner section to select an account.

|

|

Delete Payment Button

To delete a payment select the batch-id which includes the payment to be deleted and click the Delete Payment Button.

Control is then passed to the Owner Account section to select the record to delete.

|

|

Mode Display

Mode display instructs the user if they are in Add or Delete mode.

|

|

Batch ID Selection

Select a Batch ID from the drop down list or create a new batch by clicking the "Batch Button"  .

The Batch ID selected remains with the user until the current session has ended or the Batch ID is changed.

Note: A valid batch id must be selected before adding or deleting a payment.

|

|

Search Button

Click the "Search" button to search for possible candidates based on the information selected.

|

|

Refresh Button

Click the "Refresh" button clears the screen for entry of a new account.

|

|

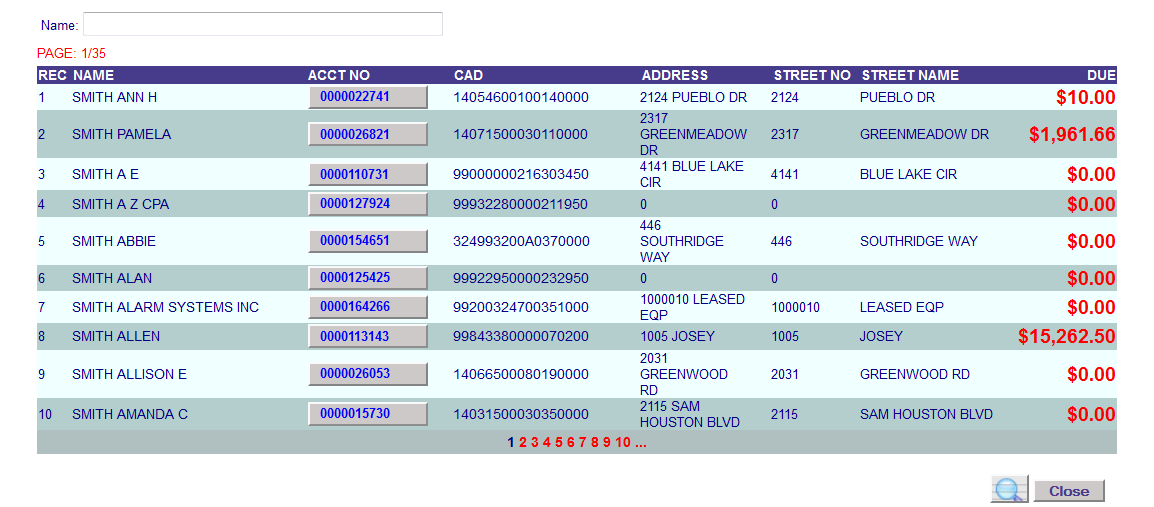

Possible Candidates Button

Clicking the Possible Candidates button brings up the popup to display the accounts which meet the selection criteria.

|

|

Generate Report Button

The Generate Report Button reprints the receipt for the account on the screen.

|

|

Total Due

The Total Due display provides the total pay off amount on this account using system default parameters.

|

|

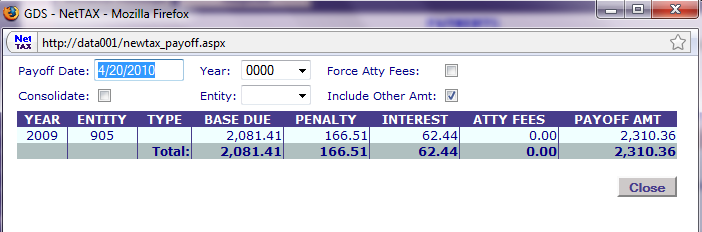

Payoff button

Clicking the "Payoff" button displays the breakdown of the Total Due Display.

|

|

Mineral Receipt Button

Clicking the "Mineral Receipt" prints the mineral receipt for the payment entered and still displayed.

|

|

Reprint Button

Click the "Reprint" button to reprint a receipt for the account displayed.

|

|

Delete Print Only Button

Click the DPO button to delete all Print Only Statements

NOTE: If you delete a Print Only record there is a receipt that has been printed and could be with a customer.

|

|

List Print Only Button

Click the "L" Button to list all unposted Print Only Payments.

|

|

Post Print Only Button

Click the "P" Button to Post all unposted Print Only Payments.

|

|

Notes Button

The Notes Button will bring up a pop-up screen with page 5 of the Tax Payer Account screen so you can add any notes you deem necessary.

|

|