| < Previous page | Next page > |

How To... Reverse a Payment for Multiple Years/Accounts

When a check is returned from the bank (insufficient funds, closed account, stop payment, etc.) it will be necessary to reverse the payment so that the account will show due again. If the returned check has paid multiple years or multiple entities, then you will need to get the amount of the tax, penalty, interest, and attorney fees paid for each year and entity. You will then add an adjustment for each year and entity keeping in mind that the adjust amount will be the sum of the tax, penalty, interest, attorney fee, and discount amount paid for that YEAR and ENTITY.

NOTE: This can also be seen as a refund. The taxpayer paid you the money with a check and the check was returned. So now you have to "refund" the money so that the account will show due. This is important to remember because if the check was entered at the end of the month and you have balanced your month end reports (which means that your books are showing that the money has been collected), then when you enter the check reversal, the adjustment is entered as if you were entering a refund.

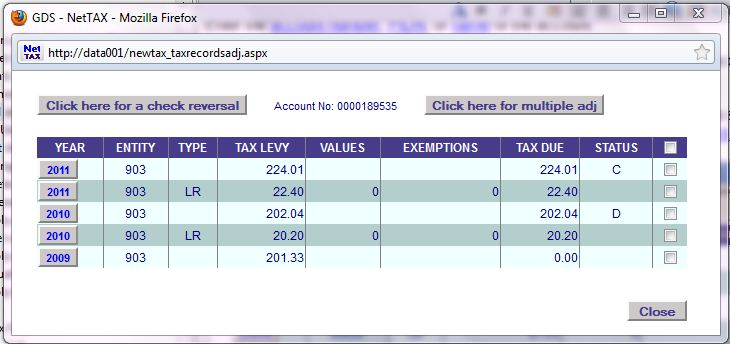

Click on the button "Click here for a check reversal".

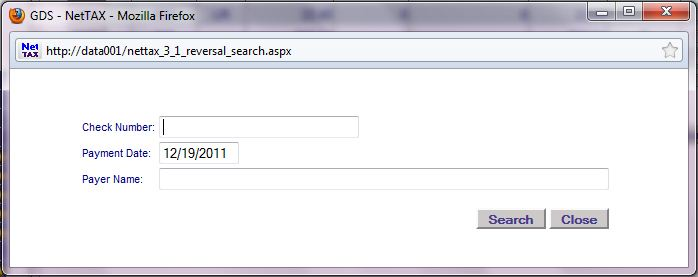

Enter the check number and Payment date of the payment to be reversed. The payer name is optional.

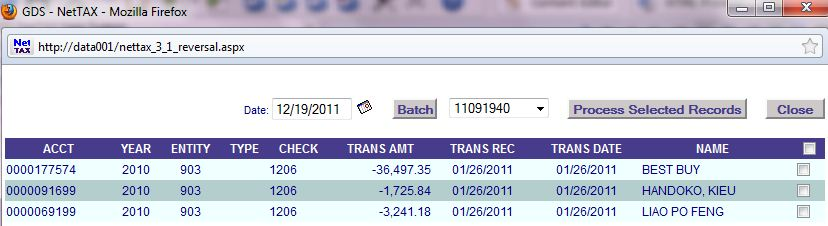

Put a check mark next to the payments to be deleted.

Note: There may be more than 1 account with the same check number paid on the same pay date.

If needed, select a Batch ID and the date the check was returned then click on the button "Process Selected Records".

Click on the “L” in the application control section to get an adjustment listing to verify that they have been entered correctly (See "How To... List Unposted Adjustments").

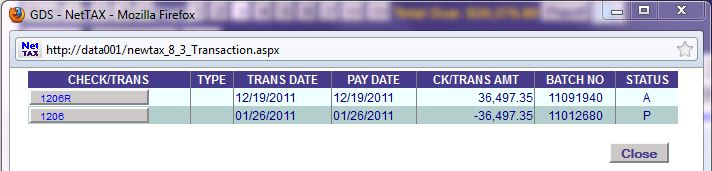

Note: At this point, the adjustments have not been posted to the accounts. If you look at page 3 of the account and click on the "Transactions" button, there will be an "A" in the "STATUS" column meaning that the adjustment has not been posted yet. The "P" means the transaction has been posted.

Note: An "R" will be added to the end of the check number to indicate that is a reversal.

|

| < Previous page | Next page > |