|

|

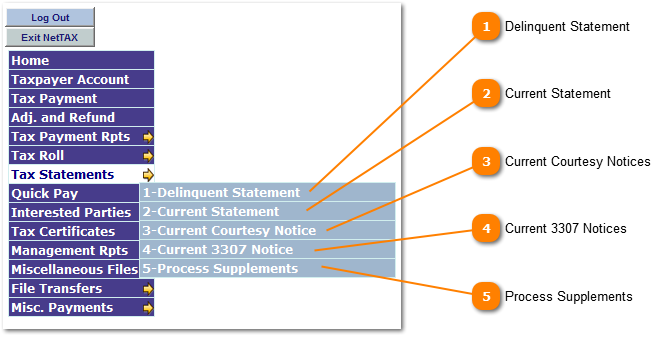

The Tax Statements Menu is where access to the programs to print tax statements are located.

Delinquent Statement

The Delinquent Statement provides the creation of delinquent tax bills based on the criteria selected in the program. There are many options and filters that are available when running delinquent statements. Information included on the delinquent tax statement includes owner name / address, property location / legal, year and entity taxes are due and payoff amounts for 3 months. | |

Current Statement

The Current Statement provides the creation of current tax bills based on the criteria selected in the program. There are many options and filters that are available when running current statements. Information included on the current tax statement includes owner name/address, property location / legal, year and entity taxes /values /exemptions / tax levy / tax due and payoff amounts for 6 months. | |

Current Courtesy Notices

The Current Courtesy Notice provides the creation of notice that a current tax bill still remains unpaid. The run is based on the critera selected in the program. There are many options and filters that are available when running courtesy notice. Information included on the courtesy notice includes owner name / address, property location / legal, year and entity tax due and payoff amount. | |

Current 3307 Notices

The Current 3307 Notice provides the creation of the legally required notice that a current tax bill still remains unpaid. The run is based on the criteria selected in the program. There are many options and filters that are available when running 3307 notices. Information included on the 3307 notice includes owner name / address, property location / legal, year and entity tax due and payoff amount. This is commonly refered to as the May notice. | |

Process Supplements

The Process Supplement application provides the notices to taxpayers for changes that have occurred on there account due to a value /exemption change. The process is based off the date range for when the changes where made in the system. The process prints; corrected statements, refund questionnaire's and supplemental letters (explaining the change). There are several options available for selection of a accounts and what is to be printed. | |

|

|