|

|

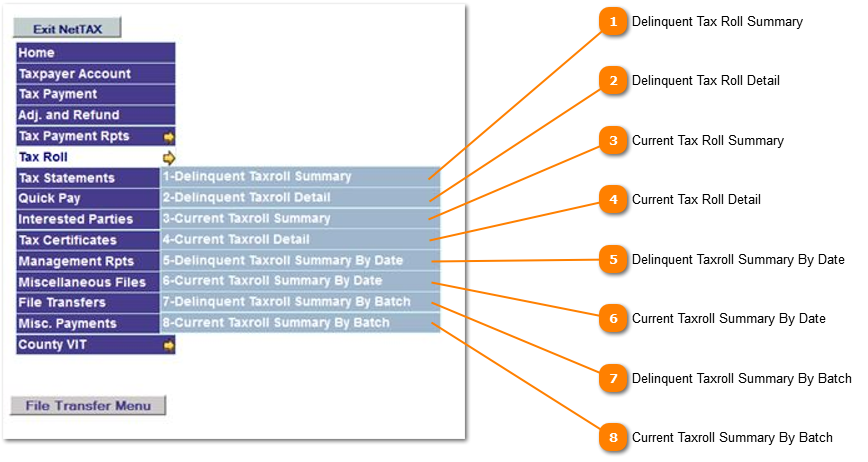

The Tax Roll Menu provides access to the applications to print the Delinquent and Current Tax Rolls.

Delinquent Tax Roll Summary

The Delinquent Tax Roll Summary provides a summary listing of the amount of delinquent taxes that are due for a specific tax year and entity. | |

Delinquent Tax Roll Detail

The Delinquent Tax Roll Detail provides a listing by account of the amount of delinquent taxes that are due. This detailed roll can be sorted by account number, pidn, owner name, zip code and mortgage code. There are many other options and filters that are available when running this report. Information included in this report includes owner name / address, property location / legal, year and entity taxes are due and payoff amounts for 3 months. | |

Current Tax Roll Summary

The Current Tax Roll Summary provides a snapshot of the status of the offices current taxes. The summary is run by entity and includes; total levy, total tax paid, total tax due, total paid, total refunds, total discounts and percent collected. | |

Current Tax Roll Detail

The Current Tax Roll Detail provides a listing by account of the amount of current taxes applied to the specific account. This detailed roll can be sorted by account number, pidn, owner name and mortgage code. There are many other options and filters that are available when running this report. Information included in this report includes owner name / address, property location / legal, year and entity values / exemptions / levy. | |

Delinquent Taxroll Summary By Date

The Delinquent Tax Roll Summary by Date provides a summary listing of the amount of delinquent taxes that are due for a specific tax year and entity by a specific date. This brings the delinquent taxroll calulated to the date specified. | |

Current Taxroll Summary By Date

The Current Tax Roll Summary by Date provides a snapshot of the status of the offices current taxes for a specific date. The summary is run by entity and includes; total levy, total tax paid, total tax due, total paid, total refunds, total discounts and percent collected calculated to the specific date provided. | |

Delinquent Taxroll Summary By Batch

The Delinquent Tax Roll Summary by Batch provides a summary listing of the amount of delinquent taxes that are due for a specific tax year and entity by a specific date. This brings the delinquent taxroll as of a specific batch number. | |

Current Taxroll Summary By Batch

The Current Tax Roll Summary by Batch provides a snapshot of the status of the offices current taxes for a specific date. The summary is run by entity and includes; total levy, total tax paid, total tax due, total paid, total refunds, total discounts and percent collected calculated as of a specific Batch Number. | |

|

|