|

|

The Current Statement program prints the current statements for a given tax year. The Current Statement screen provides the ability to print various runs using the most common parameters to meet processing needs.

Current Statements create a file in "pdf" file format (Adobe Reader). There is a limitation of approximately 8000 pages per run.

Sort By

Drop Down

The Sort By drop down lists the options available for the print order of the current statement. Statements will print in which ever order is selected.

| |

Select Year

Drop Down

Select the current year for the statement run, from the Selected Year drop down.

| |

Selected Entity

Drop Down

To print Current tax statements for a single entity, select the entity from the Selected Entity drop down. Leave as blank to print statements for all entities regardless of the tax entity.

| |

Return Mail Code

Drop Down

To print current tax statements for accounts that have a specific return mail code, enter the desired return mail code. Leave as blank to select accounts without regard to the return mail code.

| |

Selected Status

To print Current tax statements for accounts that include specific account status codes, enter the desired status code(s). Leave as blank to select accounts without regard to the account status code.

| |

Skip Status

To exclude accounts to print Current statements of a specific account status enter those status codes here. Leave blank to include accounts regardless of status code unless you select specific status codes above.

| |

Start Month

Drop Down

Select the month the statements are to be mailed. This is where the penalty, interest and attorney fee calculations will begin. Multiple months due are printed on the statement. This is the first month.

| |

Use Agent Address

Check Box

To use the address for the billing agent instead of the property owner, click the Use Agent Address check box. This only pertains to accounts that have a billing agent on file for the account. This box left unchecked prints all Current Statements to the property owner.

| |

Force Atty Fees

Check Box

Accounts that have a "S", "L" or "I" in the account status will force attorney fees on the amount due if this box is checked.

| |

Include Billing Agents

Check Box

To include accounts that have a billing agent on file check the Include Billing Agents check box. Leaving this box unchecked will skip all accounts that have a billing agent on file.

| |

Include Mortgage

Companies Check Box

To include accounts that have a mortgage company code on file check this box. Leaving this box blank will exclude accounts with a mortgage company from this run.

| |

Print Second Page

Check Box

For tax offices collecting for more than one tax entity a second page is generated which includes the required 5 year history. A printer with duplex capability can be setup to print the second page on the back of the current statement. Check the Print Second Page check box to print the multiple tax entity second page. Leave this box unchecked to only print the first page.

| |

Print Statement Summary

Check Box

To print a statement summary of what was run and how many statements where generated check this box. The summary is printed on the last sheet once all the statements have been printed.

| |

Zero Statements

Check Box

Check this box to print statements which have no Current taxes due for this account year. This includes only accounts with a valid tax record for the current year where the taxes are calculated to zero. Leaving this box unchecked will only print statements with an amount due.

| |

Skip Minerals

Check Box

To skip accounts of a property type mineral check this box. Typically minerals are printed on as a separate run and on a different format.

| |

Include Emails Check Box

Checking Include Emails will print statements of accounts with or without an email address. Leaving this unchecked will not print statements with email delivery option.

| |

Property Type Drop Down

To limit the printing of Current tax statements to include only records of a specific property type select that type from the Property Type drop down. Leave as "All Properties" to print statements for all accounts regardless of property type.

| |

Emails Only Check Box

This check box will only print statements of accounts that have an email address

| |

Data Range:

Start and End Field

The Start Field and End Field limit the statements printed based off the Sort By field selected above.

If owner name is selected and all accounts are desired leave the Start Field blank and fill the End Field with several Z's.

For a specific owner name enter the full name in both fields.

For zip code runs enter in zip+4 format with no hyphenation (762480000).

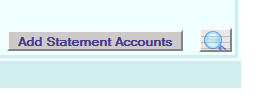

Sort order "Selected Account Numbers" provide the entry of individual accounts to print. Once selected the "Add Statement Accounts" button shows at the bottom right just before the Generate Report button.

Click the "Add Statement Accounts" button to display the popup:

Enter the desired Account No or Pidn No for the accounts to print statements for. Once all desired accounts are entered click the Generate Report button (Magnifying Glass) to display the Current statements in "pdf" form for printing. Click the "Close" button to end.

| |

Report Name

Report Name is the statement form used for the Current statement. The default system Current statement form is displayed.

| |

Generate Report

Clicking Generate Report magnifying glass creates the Current Tax Statements based of the parameters entered, in a "pdf" format..

| |

Annual Statement Button

Press the Annual Statement Button to create an annual statement based on the criteria chosen.

| |

Standalone Current Statement Button

Press the Standalone Current Statement Button to create an annual statement based on the criteria chosen.

| |

|

|