| < Previous page | Next page > |

How To... Align Previous Check Reversals

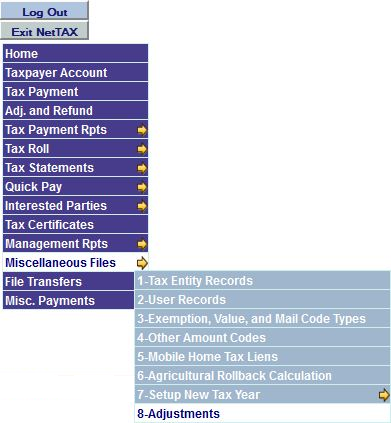

Note: This program is used to link previously entered check reversals to the check that was reversed. These previous check reversals are adjustments that were entered into the NetTAX system without using the check reversal program in adjustments.

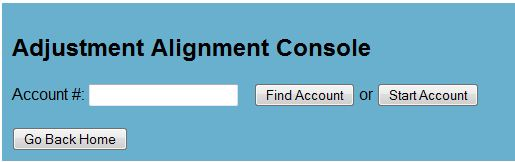

Click on the button "Start Account" to bring up the first record to be "aligned" or enter the account number from where you left off last time and click on "Find Account".

Note: You do not have to go through the whole database in one sitting. You can click on "Save and Go Back" or "Cancel" and take note of the account number to start with the next time you run this program.

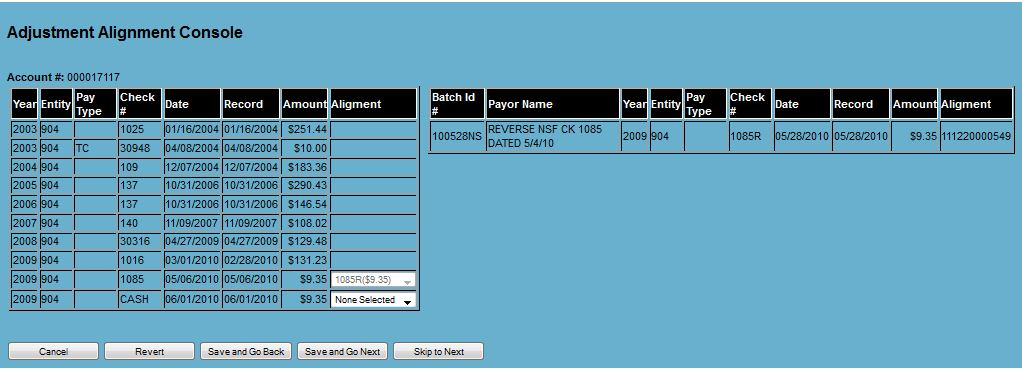

The left side will be a list of all the payments and the right side will have a list of all the adjustments. Under the Alignment column, select the adjustment that reversed the payment. Do this for any other payments that are allowing for an "alignment". If there is not an "alignment" to be made then leave the alignment column as "None Selected", then click on one of the following buttons:

"Cancel" - Don't save any changes and go back to the previous screen.

"Revert" - Undo any changes that were saved previously.

"Save and Go Back" - Save any changes and go back to the previous screen.

"Save and Go Next" - Save any changes and go to the next record to be "aligned".

"Skip to Next" - Don't save any changes and go to the next record to be "aligned".

Take note of the account number after clicking on "Cancel" or "Save and Go Back" for later reference.

|

| < Previous page | Next page > |