GDS NetTAX Help System

Main Menu

Tax Payer Account

Miscellaneous Files

NetTAX How To...

How To... Miscellaneous Payments

| < Previous page | Next page > |

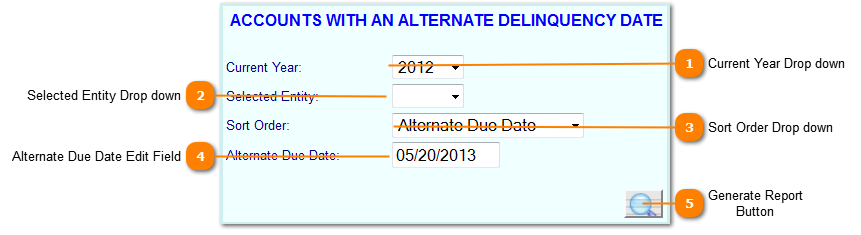

Accounts With An Alternate Delinquency Date |

| < Previous page | Next page > |

|

GDS NetTAX Help System Main Menu Tax Payer Account Miscellaneous Files NetTAX How To... How To... Miscellaneous Payments |

|

|||||

|

|

|