| < Previous page | Next page > |

How To... Write off Taxes

There are times when the taxes on a property can be written off (statute of limitations, uncollectable, ...). There are 2 ways to accomplish this in the GDS Tax system. One is to make an adjustment and the other is to change the levy to 0.00.

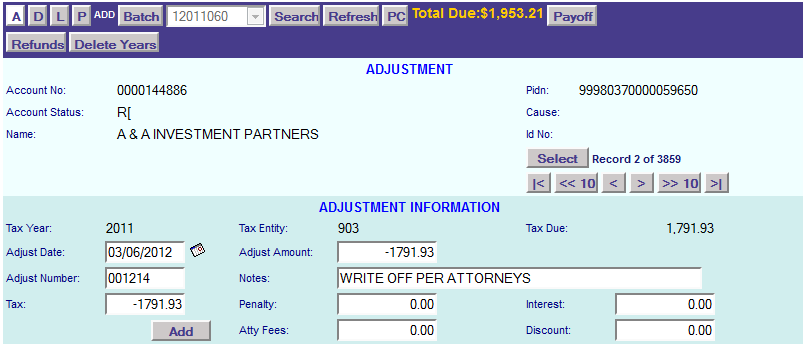

1. Making an Adjustment.

The preferred method is to make an adjustment on the account to be written off.

You will want to create a new batch just for these adjustments.

When entering these adjustments, the adjust amount will be a negative of what the tax due is. For example: If an account has 1791.93 due, then enter -1791.93 in for the adjust amount and -1791.93 in for the tax.

After entering all the accounts to be written off, save a copy of the listing for your auditors to show that you wrote these accounts off.

Now post the adjustments. See "How To... Adjustments".

When balancing at the end of the month, these adjustments wind up as taxes being paid under the tax paid column of the distribution report and the recap report.

2. Changing the levy to 0.00.

The other method is to go to page 2 of the account and then change to levy amount to 0.00. If there has been a payment made on this account, then change the levy amount to the amount of the tax paid. This way the tax due will then be 0.00. Run a levy change listing for the day these changes were made.

NOTE: Any other levy or value/exemption changes done on that day will show up on this report as well.

When balancing at the end of the month, these changes will show up under the levy changes "Additions" and "Subtractions" columns on the recap report.

|

| < Previous page | Next page > |