| < Previous page | Next page > |

How To... Change an Account Record

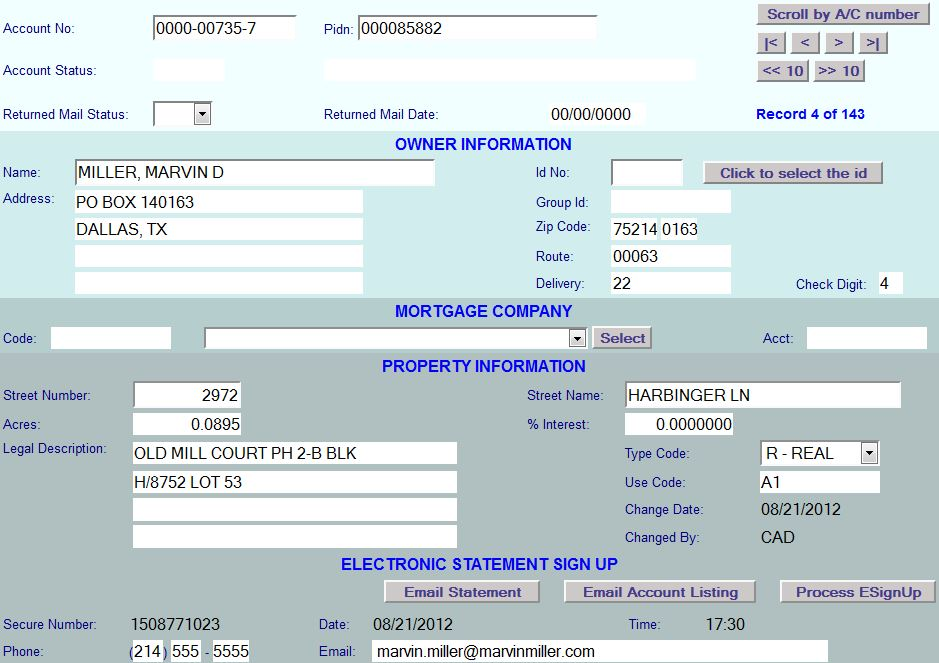

Upon selecting the account record to be changed, click on the “C” mode button

Change the fields to be changed by clicking on the field or use the tab key and make the appropriate changes.

NOTE: The % Interest is entered as a decimal and not as a percentage (eg. 10% should be entered as 0.10).

The account status field is up to 6 characters long.

Each character represents a different status.

Example: if you entered "DQS" in the account status, that would mean that the account has a deferral, a quarterly and a suit has been filed. DO NOT use multiple characters to represent a single status code.

NOTE: Reserved Account Status codes:

B = Bankruptcy

D = Deferral

I = Intervention

J = Judgment

L = Litigation

Q = Quarterly Payment

R = Disaster Relief

S = Suit

T = Mobile Home

W = Warrant

! = Law Enforcement record not for public information.

NOTE: The following are special characters and should not be used:

* = (asterisk or star)

% = (percent sign)

' = (apostrophe or single quote)

When all changes have been made, click on the “CHANGE” button

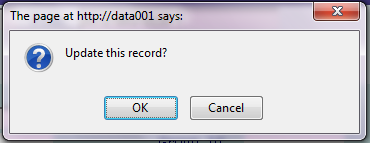

The system prompts:

Click "OK" to update this record as changed or "Cancel" to return to the Taxpayer Account Screen.

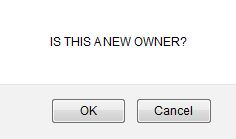

Note: If the owner name changes (whether a new owner or simply a name correction), the system will then prompt:

If this is a new owner then click on "OK" otherwise if it is a name correction then click on "Cancel".

Note: After clicking on "OK" for "IS THIS A NEW OWNER?", the system will generate a new random 10 digit secure number, blank out the email address and phone number.

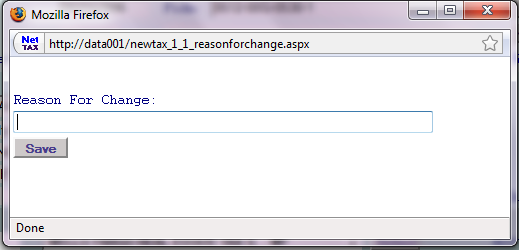

Clicking on "OK" to update this record the system prompts:

Enter the reason for making this change. The NetTAX system maintains a description of changes made to records along with the date and the user who made the change. Click the "Save" button to record the change.

NOTE: To abort this change and revert the record to it's original data, simply click the "I" mode button to change to inquiry only mode or click "Start" button to search start a new record search.

If the record did not save a message will be displayed in red letters at the bottom left of the screen. Make the correct changes following the instructions above.

NOTE: The Account No and PIDN must be unique to the table and cannot be used on more than one Account Record. If using Owner ID all changes to the Owner Information must be changed in Owner ID Records. Owner Name field cannot be blank.

|

| < Previous page | Next page > |