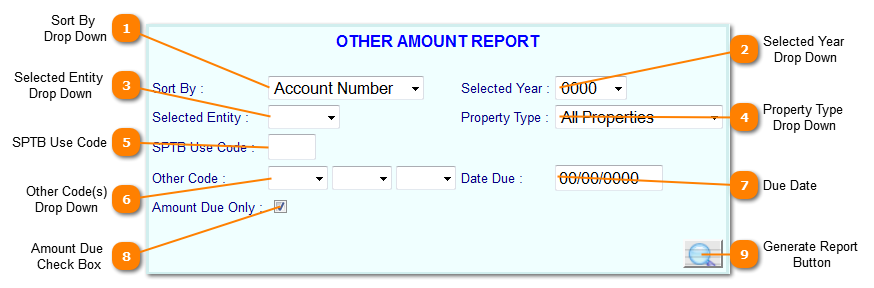

The Other Amounts Report provides a listing of specific other amounts assigned to tax records.

Sort By

Drop Down

Select the order in which the report is to be printed from an option on the Sort By drop down.

|

|

Selected Year

Drop Down

Select the specific tax years records to list the other codes. To select all years leave the Selected Year "0000".

|

|

Selected Entity

Drop Down

Select the a specific tax entity for the listing or leave blank to include all entities.

|

|

Property Type

Drop Down

Select tax records of a specific property type or leave as "All Properties" to include all property types.

|

|

SPTB Use Code

Select a specific State Property Tax Use Code to limit the listing to only those matching the entered use code. Leave blank to print all records regardless of use code.

|

|

Other Code(s)

Drop Down

To limit the report to specific other codes, select the appropriate code from the Other Code drop downs. Up to three specific codes maybe selected per report. Leave the fields blank to include all other codes in this listing.

|

|

Due Date

To print other amounts with a specific due date enter the date in mm/dd/yyyy format. Leave blank to print other amounts regardless of due date.

|

|

Amount Due

Check Box

Check the Amount Due Check Box to include only records that remain due. Unchecked the report will print records with all other amounts coded regardless of whether they have been paid or not.

|

|

Generate Report

Button

Click the Generate Report button to print the Other Amounts Report based off the parameters entered. The report will display in a "pdf" format.

|

|