| < Previous page | Next page > |

How To... Add, Change or Delete a Mobile Home Tax Lien Record

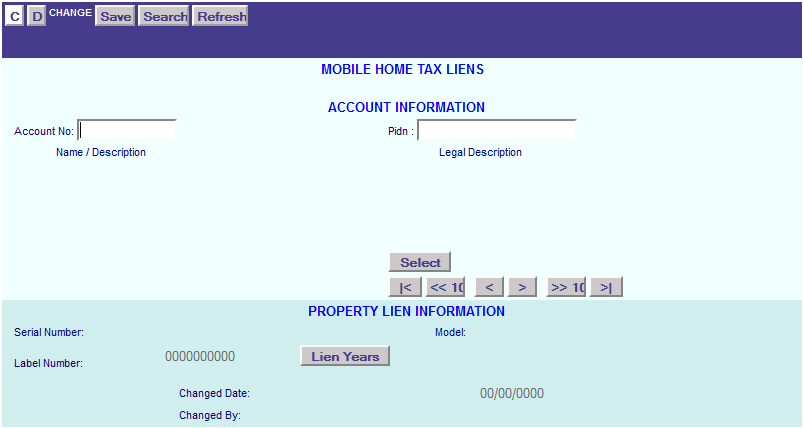

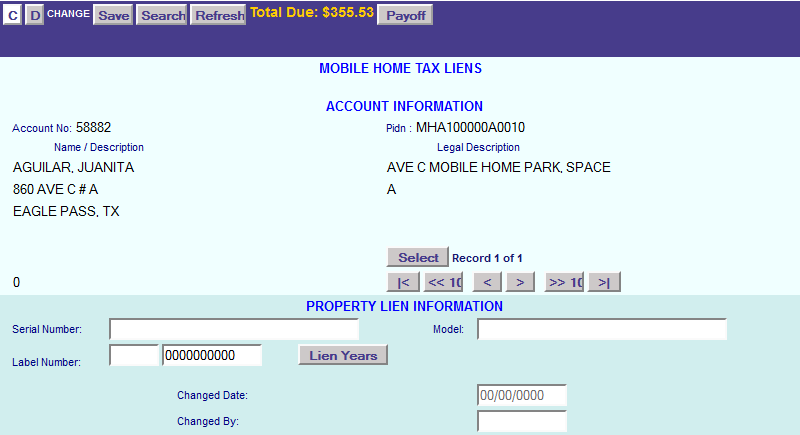

To add or change a mobile home tax lien record, click on the “C” button in the Application Control section to enter the “CHANGE” mode. Enter the account number or PIDN of the account desired.

If this is the first time that a lien has been placed on this mobile home then you will need to enter the Serial number, Model, and Label Number for this record.

Serial Number: This field can be up to 22 characters long.

NOTE: This field is for ONE NUMBER ONLY even if the home is a multi-section home. The state's computer will not find a match if more than one serial number is listed. Do not combine the serial numbers. If the Serial number is unknown then leave this field blank, DO NOT enter "UNKNOWN" or zeroes or anything else in this field.

Examples:

Right: HOTX123456A or TXFL1A1234

Wrong: HOTX123456A/B or TXFL1A/B1234

Label Number: The label number contains a three letter prefix followed by seven numbers.

NOTE: This field is for ONE NUMBER ONLY even if the home is a multi-section home. The state's computer will not find a match if more than one label number is listed. Do not combine the label numbers. If the Label number is unknown then leave the prefix field blank and the numbers as zeroes, DO NOT enter anything in this field.

Model: Enter the model name of this mobile home. This field is no longer required by the state but may be useful information for the tax collector.

If the model, label number, or serial number are changed, then click on the

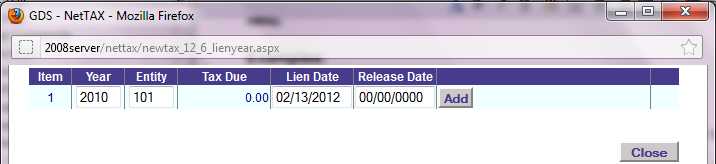

Enter the year and entity to be put into lien and then press the

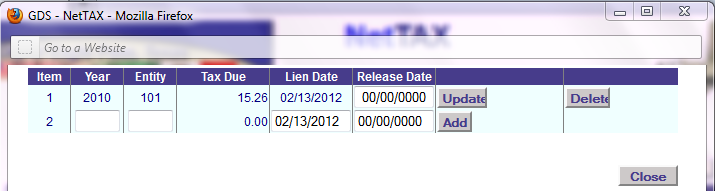

If the lien has been paid then enter the release date and then click on the

NOTE: Before deleting a line item, verify that the account is no longer in lien by the state.

|

| < Previous page | Next page > |