| < Previous page | Next page > |

How To... Distribution Report

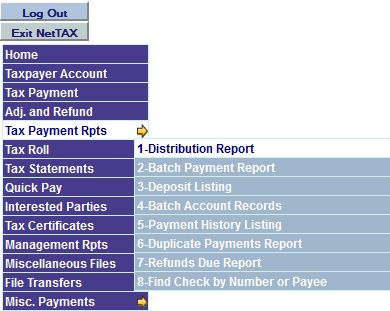

The Distribution Report can be accessed by selecting "Distribution Report" from the "Tax Payment Reports" menu off the main menu.

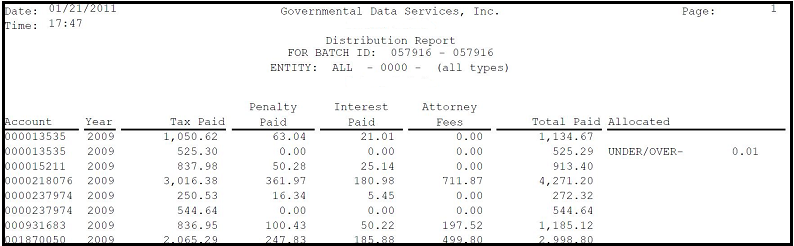

The Distribution Report will contain the account number, year, tax, penalty, interest, and attorney fees paid for all the transactions for the selected criteria. The summary page will have the totals by year, along with the M&O and I&S totals. The report will be broken down by entity also.

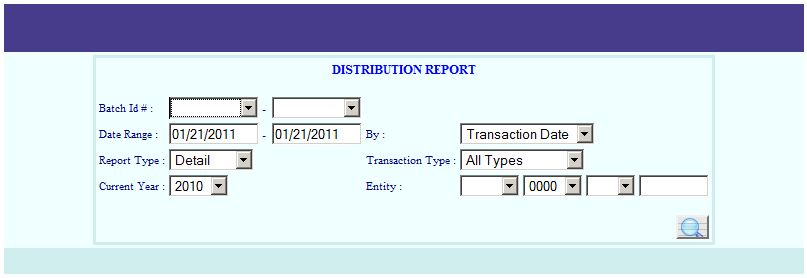

The report is either ran by a "Batch ID" range or a "Date Range". If the batch ID's are left blank then the report is run by the date range. If a batch # is entered it will be run by a batch range. If only one batch # is entered, then the report will only include that batch as well as a grand total summary.

NOTE: The reason we suggest using either the yyyymmdd or yymmdd format (eg. “20100525” or “100525 ”) when creating a batch is because this will keep the batch ID's in chronological order. If you use the month first when trying to balance, you may end up getting all years transactions with that month instead of getting just a specific years transactions. Using the year first will keep the batches in order and will be helpful in finding errors if out of balance. The Batch ID's are sorted alpha numerically and are not treated as numbers.

Select Transaction Date to select the actual system date the transaction was recorded/created.

Select the Record/Pay Date to select the date used to calculate P&I or to print on the receipt.

To generate a complete detail (transaction by transaction) listing select "Detail". To print only the summary totals select "Summary".

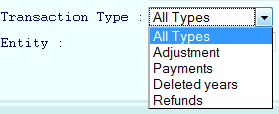

To generate the Distribution Report for specific transaction types select a valid type from the Transaction Type drop down or select "All Types" to get all transaction types.

Select Adjustments to get only Adjustments, Select Payments to get only Payments, etc.

The summary distribution breaks down the transactions into two categories, delinquent and current. The current year selected will be used for the current year.

The next 4 fields will be your selected Entity, selected Year, selected Type, and selected Status. If you want the report for one specific entity then select the entity in the first drop down box. If you want just one specific year then select a year in the second drop down box. If you want a specific payment type (eg. LR, OP, TP, ...) then select a type in the third drop down box. If you want just transactions with a specific account status then enter the status desired.

Miscellaneous payments that are made in the system will appear as their own entity at the beginning of the report and will be added in with the grand totals at the end of the report.

Now click on the magnifying glass for the report.

|

| < Previous page | Next page > |