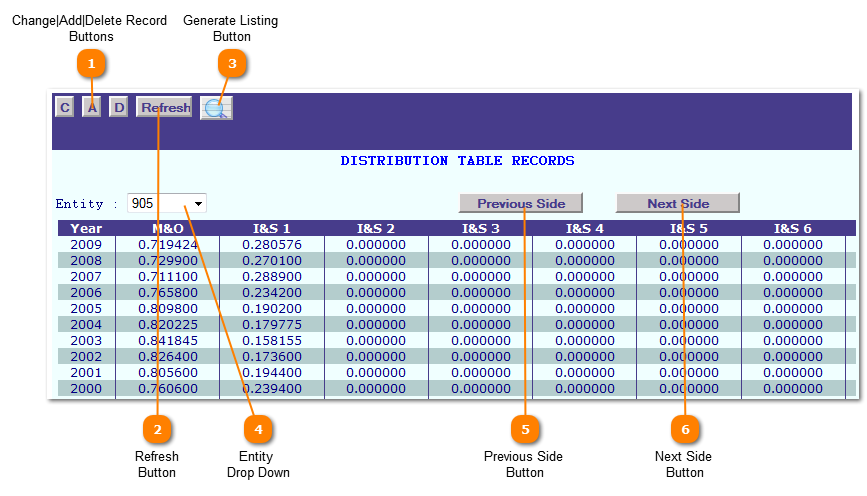

Distribution Table Records

The Distribution Table sets parameters for specific tax year and tax entity. The information is contained on two pages (Previous Side and Next Side).

Before records for a tax year and tax entity can be entered a distribution record must be contained in this table.

The distribution table contains the following parameters:

-

Distributing taxes between Maintenance / Operations and Debt Service funds,

-

Tax Rates and Assessment Ratios,

-

Attorney Fee Percentage,

-

Discount Percentages and

-

Standard Delinquency Date

Change|Add|Delete Record

Buttons

Change Record button places the application is the change mode. In order to change a record select a entity from the Entity drop down before clicking the Change Record button.

Distribution records are displayed with an edit option at the far left column of the row to change that row click the "Edit" text.

Once a row is selected for "Edit" click the "Next Side" button to change data on the remaining record.

Add Record button places the application is the add mode. In order to add a record select an entity from the Entity drop down before clicking the Add Record button.

A new distribution line displays at the end of the bottom of the list available to entry. Enter the requested information and click the "Add" button.

Click the "Next Side" button to add data on the remaining record.

Delete Record button places the application is the delete mode. In order to delete a record select a entity from the Entity drop down before clicking the Delete Record button.

Distribution records are displayed with an "Delete" button at the far left column of the row to delete that row click the "Delete" button.

|

|

Refresh

Button

Press the "Refresh" button to clear all fields and start a new record.

|

|

Generate Listing

Button

Generate Listing Button creates a listing of the records on file. The listing is created as a .pdf file.

|

|

Entity

Drop Down

The Entity Drop Down selects the tax entity to Add, Change or Delete distribution records. The entity must be selected before selecting a mode.

|

|

Previous Side

Button

Previous Side button is the first part of the distribution record. When viewing the second part of the record click the "Previous Side" to return to the 1st part of the distribution record.

|

|

Next Side

Button

Next Side button is the second part of the distribution record. When viewing the first part of the record click the "Next Side" to view the 2nd part of the distribution record.

|

|